Rocket mortgage home loan calculator invites you to take control of your home buying journey through an intuitive and accessible financial tool. From the moment you open the calculator, you’re guided through a seamless process that reveals potential monthly payments, interest costs, and financing scenarios, making complex mortgage decisions approachable and transparent.

Designed for both first-time homebuyers and experienced homeowners, this calculator breaks down the numbers and offers customizable options so you can tailor every calculation to your unique situation. Whether you’re exploring different loan amounts, down payments, or interest rates, the rocket mortgage home loan calculator provides real-time insights to help you make confident and informed financial choices as you navigate the mortgage landscape.

Overview of Rocket Mortgage Home Loan Calculator

The Rocket Mortgage Home Loan Calculator serves as a dynamic digital solution for prospective homebuyers who want to understand their mortgage possibilities quickly and clearly. With its intuitive design, the calculator aims to simplify the complex process of estimating loan costs, monthly payments, and the overall financial impact of a mortgage decision before starting a formal application.

Designed to address a variety of financial scenarios, this tool accommodates first-time buyers, refinancing homeowners, and anyone considering changes to their mortgage terms. It helps users plan for different down payment amounts, interest rates, and loan terms, offering a comprehensive outlook on the affordability of their desired property.

The Rocket Mortgage home loan calculator is an essential resource for demystifying the numbers behind homeownership, streamlining the early stages of the mortgage application, and empowering users to make informed decisions with confidence.

Key Features and Tools: Rocket Mortgage Home Loan Calculator

The calculator is packed with robust features that elevate user experience and deliver accurate, actionable insights. Its responsive interface and integration with Rocket Mortgage’s suite of tools make it especially valuable for a wide range of users.

| Feature | Description | Benefit | Example Use |

|---|---|---|---|

| Monthly Payment Estimator | Calculates your estimated monthly mortgage payment based on input data | Immediate clarity on monthly costs | Budgeting for a new home purchase |

| Amortization Schedule Generator | Breaks down each payment into principal and interest over the life of the loan | Visualizes long-term payment trajectory | Evaluating early payoff strategies |

| Down Payment Impact Analysis | Shows how different down payment amounts affect your loan and payment | Optimizes upfront investment | Comparing 5% vs. 20% down payment options |

| Integration with Pre-Approval Tools | Seamlessly links with Rocket Mortgage’s pre-approval and application process | Saves time and reduces duplicate data entry | Moving from estimate to formal application |

User interface elements like real-time sliders, interactive graphs, and clearly labeled input fields enhance usability. The calculator’s ability to synchronize with your Rocket Mortgage account allows you to transfer saved estimates directly into your formal application, making the transition from estimation to execution effortless.

Step-by-Step Guide to Using the Calculator

Navigating the Rocket Mortgage Home Loan Calculator is straightforward, thanks to its stepwise process that guides users from data entry to result interpretation. Following these steps helps ensure accuracy and value from the tool.

- Start by entering your target home price or loan amount.

- Specify your planned down payment, either as a percentage or dollar amount.

- Input the expected interest rate based on market conditions or pre-qualification offers.

- Select your desired loan term, typically 15 or 30 years.

- Add estimates for property taxes, homeowners insurance, and any HOA fees if prompted.

- Submit the information to view your estimated monthly payment and loan breakdown.

For best results, keep these tips in mind:

- Double-check all figures for accuracy, especially property taxes and insurance estimates.

- Adjust down payment and term sliders to explore different financial scenarios.

- Use the advanced options for greater customization, such as including PMI or extra monthly payments.

Once you’ve entered your data, the calculator will display a summary of your estimated monthly payment, including principal, interest, taxes, and insurance. You’ll also see a detailed amortization schedule and the total interest you can expect to pay over the life of the loan. This output can be used to compare different scenarios and select the option that best fits your budget.

Input Variables and Customization Options

The calculator relies on several core inputs to generate accurate estimates. Understanding these variables and making use of available customization options can significantly impact your loan calculations.

- Loan Amount: The total amount you plan to borrow for your home purchase.

- Interest Rate: The annual percentage rate offered or anticipated.

- Down Payment: The upfront cash you’re putting down, impacting loan size and PMI.

- Loan Term: The length of the mortgage, commonly 15 or 30 years.

Additionally, advanced customization settings let users personalize calculations further:

- Property Taxes and Homeowners Insurance: Including these provides a more realistic monthly payment estimate.

- PMI (Private Mortgage Insurance): Required for down payments under 20%.

- Additional Monthly Payments: Allows planning for accelerated loan payoff.

| Input Type | Standard Input | Advanced Customization | Impact on Calculation |

|---|---|---|---|

| Down Payment | Dollar amount or percentage | Sliding scale, PMI calculation | Alters loan size, PMI, and monthly cost |

| Loan Term | 15 or 30 years | Custom term input | Changes payment amount and interest paid |

| Interest Rate | Manual entry | Adjust for rate locks, discounts | Directly affects total interest paid |

| Taxes/Insurance | Estimated averages | Local data input, HOA fees | Adds realism to the monthly payment |

Interpreting Results and Output Data

After inputting your information, the calculator provides a variety of output data that is both comprehensive and easy to understand. These details are vital for making well-informed financial decisions regarding your home loan.

- Estimated Monthly Payment: Includes principal, interest, taxes, and insurance.

- Amortization Schedule: Breaks down each payment over time, showing how your loan balance decreases.

- Total Interest Paid: Projects how much you’ll spend on interest for the entire loan term.

- Payment Breakdown: Visualizes how much of each payment goes to different components.

Interpreting these results enables you to compare different loan structures, anticipate future costs, and plan for early repayment strategies where applicable.

| Output Type | Description | User Action |

|---|---|---|

| Estimated Payment | Monthly payment based on all entered variables | Adjust budget or home price as needed |

| Amortization Table | Year-by-year breakdown of principal and interest | Plan for extra payments or early payoff |

| Total Interest | Sum of interest paid over loan life | Compare loan term scenarios |

| Payment Distribution | Graph showing split between principal, interest, taxes, and insurance | Identify savings opportunities |

Advantages of Using the Rocket Mortgage Home Loan Calculator

Compared to old-fashioned, manual mortgage calculations or less versatile online tools, the Rocket Mortgage Home Loan Calculator offers substantial benefits that simplify and enhance the home financing process.

| Calculator | Unique Benefits | Limitations | User Experience |

|---|---|---|---|

| Rocket Mortgage | Integration, real-time updates, detailed breakdowns, direct application link | Assumes standard loan scenarios, relies on user input accuracy | Seamless, intuitive, mobile-optimized |

| Generic Online Calculator | Basic payment estimate, simple layout | Lacks advanced options, no account integration | Basic, sometimes clunky interface |

| Manual Spreadsheet | Full customization, user-controlled formulas | Time-consuming, high knowledge requirement | Complex, error-prone |

| Bank Website Tools | Direct from lender, sometimes localized rates | Limited feature set, not always up-to-date | Varies by provider |

- Instant, detailed feedback on a wide range of loan scenarios.

- Integration with Rocket Mortgage’s pre-approval and loan tracking tools.

- Mobile-friendly design for on-the-go calculations.

- Visual breakdowns that make complex information easy to understand.

- Especially valuable for first-time buyers who may be unfamiliar with mortgage dynamics.

Practical Scenarios and Use Cases

The Rocket Mortgage Home Loan Calculator is built for real-world use, suiting various homebuyer and homeowner profiles. Here are a few scenarios illustrating its practical applications.

| User Profile | Scenario | Calculator Use | Outcome |

|---|---|---|---|

| First-Time Buyer | Evaluating affordability of homes in a new area | Compares several loan amounts and down payments | Selects a home within comfortable budget |

| Refinancing Homeowner | Assessing potential savings from refinancing at a lower rate | Inputs current vs. new rates and terms | Decides if refinancing is financially beneficial |

| Investor | Planning for a second property purchase | Estimates monthly payments for investment property loans | Calculates expected cash flow and ROI |

| Growing Family | Upsizing from condo to single-family home | Models impact of higher home price and taxes | Adjusts search criteria for affordability |

Limitations and Considerations

While the Rocket Mortgage Home Loan Calculator is a powerful tool, it’s important to be aware of its limitations and underlying assumptions. Users should recognize what the calculator can and cannot account for in their financial planning.

- Assumes consistent interest rates and does not account for adjustable-rate mortgages without manual adjustment.

- Relies on user-provided estimates for taxes, insurance, and HOA fees, which may vary significantly by location.

- Does not factor in closing costs, maintenance, or potential future changes in income or expenses.

- Provides estimates only—actual lender offers may differ based on credit, property type, and changing market conditions.

For best results, users should supplement calculator outputs with real-time market data, lender consultations, and guidance from financial professionals. This approach ensures that their mortgage planning is as accurate and comprehensive as possible.

Additional Resources and Support

To maximize the utility of the home loan calculator, Rocket Mortgage offers a range of supporting resources and direct support channels. These tools help users find solutions to common questions and get personalized guidance throughout the mortgage process.

- Rocket Mortgage learning center: Offers articles, guides, and mortgage basics for every stage of the homebuying journey.

- Pre-approval and application portals: Connect calculator results directly to your Rocket Mortgage account.

- Live chat with mortgage specialists: Answers specific concerns in real time.

- Comprehensive FAQs and help documentation: Step-by-step tutorials for using the calculator and understanding mortgage terms.

| Channel | Description | Availability | Direct Access Method |

|---|---|---|---|

| Live Chat | Instant messaging with mortgage experts | Daily, extended hours | On-site chat icon or popup |

| Phone Support | Direct call center for complex questions | Business hours, weekends | 1-800 number listed on site |

| Email Support | Detailed responses for non-urgent inquiries | 24/7 submission, response in 24–48 hours | Support email form on website |

| Help Center | Searchable database of tutorials and guides | 24/7 online access | Help/documentation section |

Tutorials and help documentation are easily accessible within the calculator interface, guiding users through each feature step by step and providing examples for common mortgage scenarios.

Visual Illustrations and Descriptive Walkthroughs

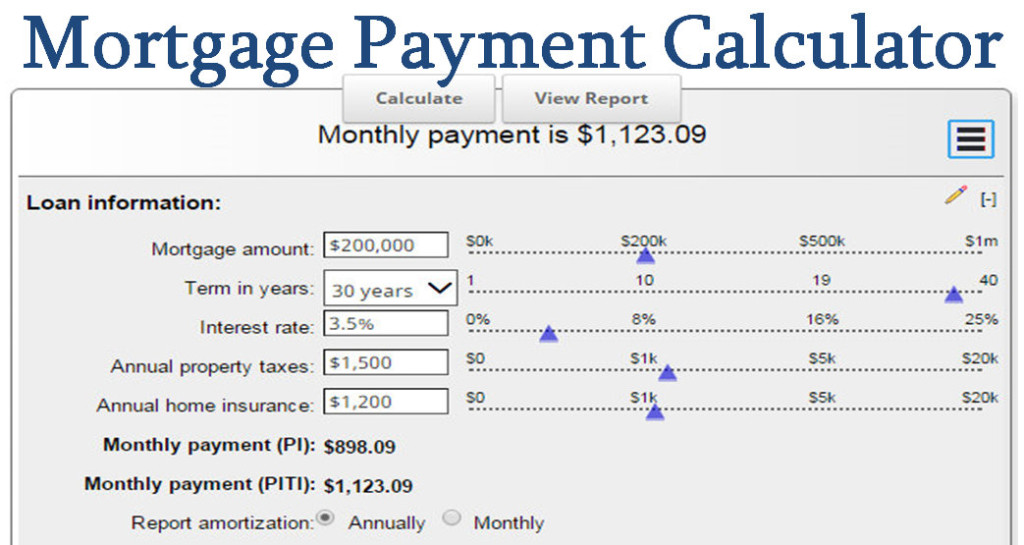

The Rocket Mortgage Home Loan Calculator interface is designed to be visually engaging and easy to navigate, whether accessed on desktop or mobile devices. Upon opening the calculator, users are greeted by a modern layout featuring large, clearly labeled input fields and interactive sliders for adjusting amounts and percentages.

The top section of the interface invites users to enter their target home price or loan amount. Directly below, sliders and dropdowns allow adjustment of down payment, interest rate, and loan term, updating the results in real time as changes are made. Interactive graphs display projected monthly payments, while a payment breakdown chart visually segments principal, interest, taxes, and insurance.

As users scroll down, they encounter an expandable amortization schedule. This table shows how each monthly payment affects both principal and interest over the entire loan term, with color-coded bars for quick interpretation. Tooltips and embedded help icons offer quick explanations for unfamiliar terms or calculations.

For example, imagine a first-time homebuyer entering their desired $350,000 home price, selecting a 20% down payment, and adjusting the interest rate slider to 6.25%. Instantly, the calculator displays an estimated monthly payment of around $1,730, including all relevant costs. The user clicks to view the amortization table, revealing that they will pay approximately $124,000 in interest over 30 years. Seeing this, they experiment with a 25% down payment, noting how the monthly payment and total interest decrease accordingly, all without leaving the page or entering redundant data.

Each step is intuitive: enter information, review instant results, and interact with advanced settings or visualizations as needed. The overall experience is designed to be both informative and empowering, guiding users from curiosity to actionable insights seamlessly.

Final Conclusion

In summary, the rocket mortgage home loan calculator stands out as a powerful yet user-friendly resource that transforms complicated mortgage calculations into clear, actionable information. By offering interactive features and practical guidance, it empowers users to understand their options, anticipate costs, and make the best possible decisions on their path to homeownership or refinancing. Explore, customize, and get clarity on your mortgage with confidence.

Commonly Asked Questions

Is the rocket mortgage home loan calculator free to use?

Yes, the rocket mortgage home loan calculator is completely free to use and accessible to anyone interested in estimating their mortgage payments.

Does using the calculator affect my credit score?

No, using the calculator does not require a credit check and has no impact on your credit score.

Can I use the calculator for refinancing scenarios?

Yes, the calculator provides options to estimate monthly payments and costs for both new home purchases and refinancing existing mortgages.

How accurate are the estimates from the calculator?

The estimates are based on the information you enter and typical market conditions. For exact figures, it’s best to consult a mortgage professional.

Can I save or share my results from the calculator?

Most versions allow you to print, download, or share your results via email for future reference or discussion with a lender.