business inventory account is the backbone of how companies track, manage, and report the goods they buy and sell. Before you can master running a business, you need to understand how your inventory is accounted for and why it matters. Every transaction linked to inventory, from raw materials to finished goods, finds its place in the inventory account, shaping the financial health of the business.

This topic dives into everything you need to know about inventory accounts, including the different types, how they’re managed, and the accounting methods that impact your bottom line. You’ll explore best practices, common pitfalls, and practical examples that show how inventory flows through a business, making it clear why getting your inventory account right is crucial for accurate financial reporting and smart business decisions.

Business Inventory Account: Definition, Types, and Management

Managing inventory is a critical component of running a successful business, regardless of size or industry. A business inventory account serves as the foundation for tracking goods and materials, supporting both operational efficiency and accurate financial reporting. Understanding the nuances of inventory accounts, their types, and best practices for managing them is essential for maintaining profitability and regulatory compliance.

Definition and Purpose of Business Inventory Account

A business inventory account is a specific ledger within a company’s accounting system used to record the value and movement of goods and materials owned by the business. This account plays a pivotal role in monitoring stock levels, supporting purchasing decisions, and determining the cost of goods sold (COGS) for financial reporting purposes. Unlike other asset accounts, such as cash or receivables, inventory accounts reflect tangible products meant for sale or use in production, making them dynamic and central to day-to-day operations.

The primary objectives of maintaining a dedicated inventory account include ensuring accurate valuation of current assets, facilitating efficient resource allocation, and supporting both operational and strategic decision-making. By diligently tracking inventory, businesses can avoid stockouts, minimize excess holding, and provide transparent data for stakeholders and auditors.

Types of Inventory Accounts

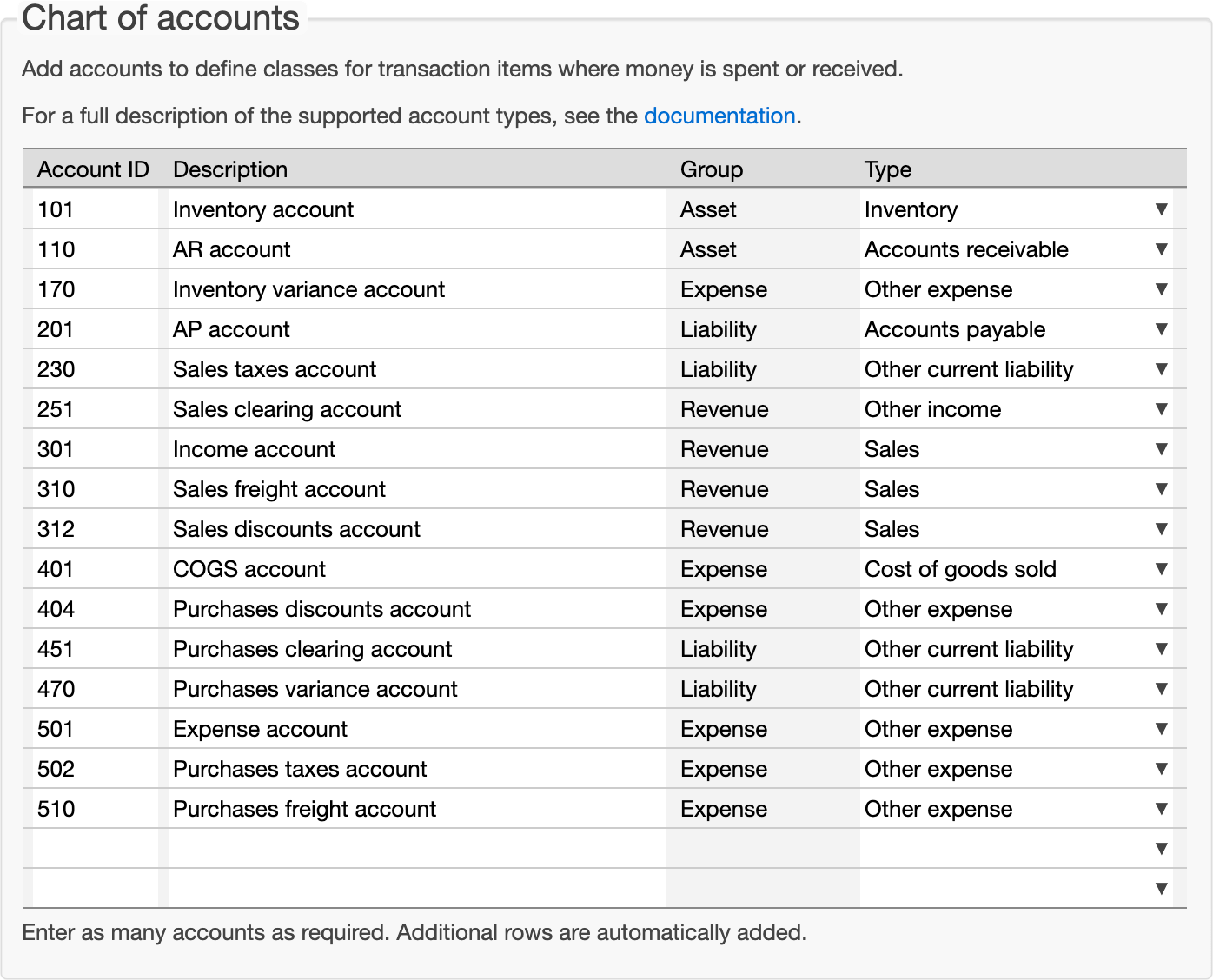

Inventory accounts can be categorized based on the stage of the production process or the nature of the goods being managed. Understanding these types helps businesses tailor their accounting practices to their operational model and industry requirements. Below is a comprehensive overview of the main inventory account types, organized for clarity and comparison:

| Account Type | Description | Example Industries | Typical Use Case |

|---|---|---|---|

| Raw Materials | Items acquired for use in the production process before any transformation. | Manufacturing, Construction | Tracking wood, steel, chemicals for product assembly or building projects. |

| Work-in-Progress (WIP) | Goods that are partly completed but not yet ready for sale. | Automotive, Electronics, Aerospace | Monitoring unfinished cars, circuit boards, or aircraft during assembly. |

| Finished Goods | Products that have completed the manufacturing process and are ready for sale. | Retail, Wholesale, Food & Beverage | Managing packaged food, consumer electronics, or clothing inventory. |

| Merchandise Inventory | Goods purchased by retailers or distributors for resale, without further processing. | Supermarkets, E-commerce, Bookstores | Tracking books, electronics, or apparel bought for direct sale to customers. |

Different sectors rely on varying inventory account types. Manufacturers often maintain all three primary accounts—raw materials, WIP, and finished goods—while retailers typically focus on merchandise inventory. This distinction shapes inventory management, reporting, and operational workflows in each industry.

Inventory Accounting Methods

The method chosen to track and value inventory directly influences both tax liabilities and reported profitability. The three most common inventory accounting methods are FIFO (First-In, First-Out), LIFO (Last-In, First-Out), and Weighted Average. Each method has unique implications for cost allocation, profit calculation, and financial statement presentation.

| Method Name | Description | Advantages | Potential Drawbacks |

|---|---|---|---|

| FIFO | Assumes the oldest inventory items are sold first and newer purchases remain in stock. | Simplifies cost flow and reflects actual physical movement for many businesses. Higher reported profits when prices are rising. | Can increase tax liability in inflationary periods. Ending inventory may be overvalued if prices fluctuate dramatically. |

| LIFO | Assumes the most recently acquired items are sold first, with older stock remaining in inventory. | Reduces taxable income during inflation by matching recent higher costs with current sales. | Not permitted under IFRS. Older inventory costs may understate current asset value on the balance sheet. |

| Weighted Average | Calculates an average cost per unit after each purchase, blending all inventory costs together. | Smooths out price fluctuations and is easy to apply in high-volume environments. | May not reflect actual physical flow of goods, leading to less precise cost control in some industries. |

Businesses choose inventory accounting methods based on regulatory requirements, tax planning, and the nature of their inventory turnover. Consistency in method usage is vital for accurate financial reporting and year-over-year comparisons.

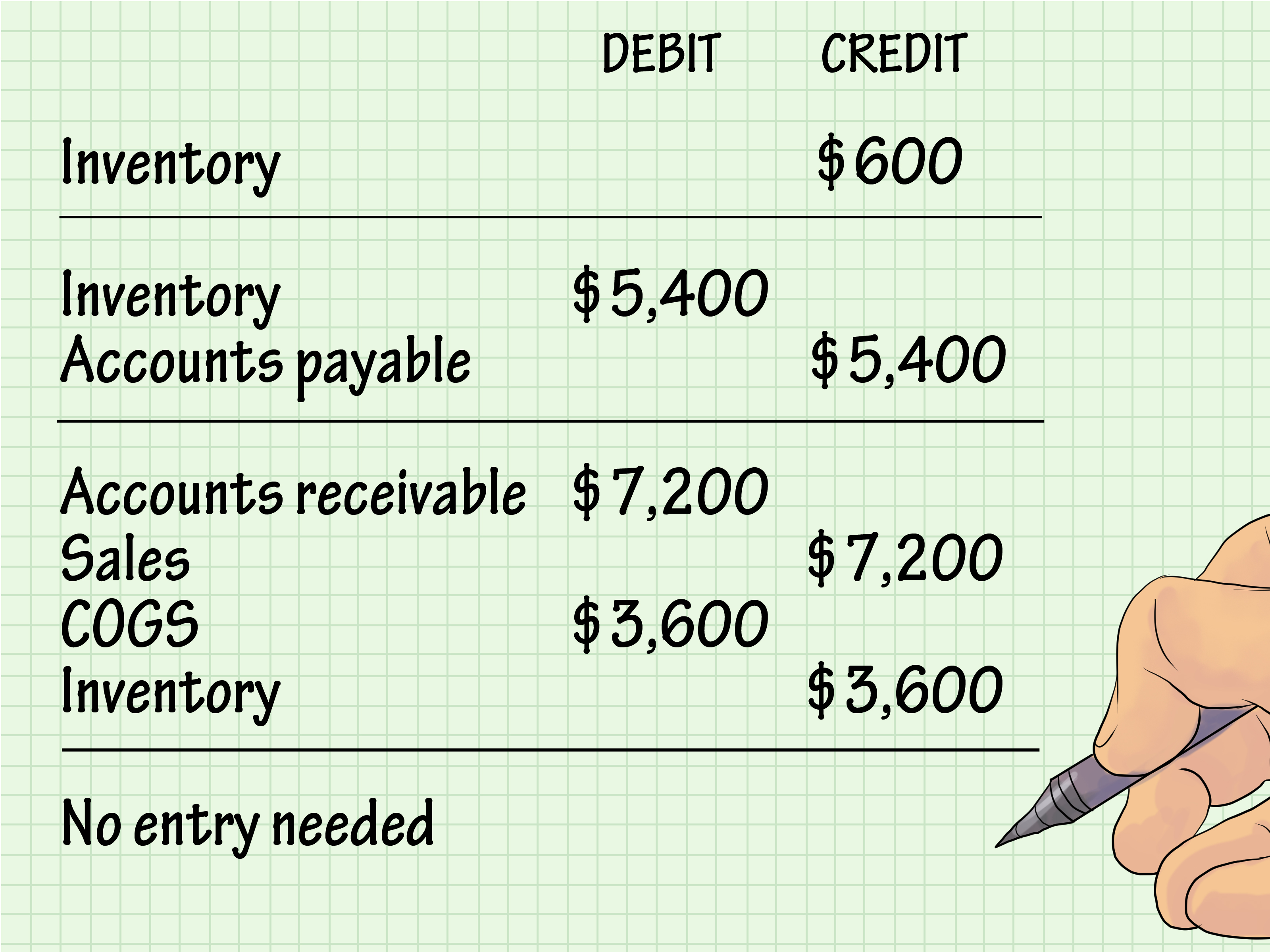

Recording and Managing Inventory Transactions

Accurate recording of inventory transactions is crucial for maintaining reliable financial data and supporting smooth operations. Each movement of inventory—whether a purchase, sale, or adjustment—must be properly documented and reflected in the inventory account. Inaccurate records can lead to costly errors, stock discrepancies, and compliance issues during audits.

Common inventory transaction types and their documentation typically include:

- Inventory Purchases: Supported by purchase orders, supplier invoices, and receiving reports.

- Sales of Inventory: Documented with sales invoices, shipping documents, and customer receipts.

- Inventory Adjustments: Backed by inventory count sheets, adjustment memos, and manager approval forms.

- Returns (to suppliers or from customers): Accompanied by return authorizations and credit memos.

- Transfers between Locations: Tracked with transfer orders and updated inventory logs.

Establishing a consistent process for recording and reviewing these transactions helps businesses prevent errors, uncover theft or shrinkage, and streamline reconciliation efforts.

Inventory Valuation Techniques

Valuing inventory correctly is essential for accurate financial statements and tax calculations. Different valuation techniques offer varying benefits depending on the business’s needs, inventory nature, and market conditions. The choice of technique impacts reported profits, asset values, and cost of goods sold, which in turn affect business decisions and stakeholder perceptions.

| Technique | Key Features | When to Use | Example Calculation |

|---|---|---|---|

| Specific Identification | Directly assigns cost to each individual item sold or remaining in inventory. | High-value or unique items with easily traceable costs, such as jewelry or vehicles. | Sell a watch purchased for $2,000; COGS assigned is exactly $2,000. |

| FIFO (First-In, First-Out) | Uses cost of earliest purchased goods for items sold; newer costs remain in inventory. | Perishable goods, industries where oldest stock must be sold first (e.g., food retail). | If 100 units bought at $10 and another 100 at $12, sales are valued at $10 until those units are depleted. |

| LIFO (Last-In, First-Out) | Applies cost of most recent purchases to items sold; older costs remain in inventory. | Industries experiencing regular price increases, primarily in the US under GAAP. | Sell 50 units; if last purchased at $12, COGS for those units is $12 each. |

| Weighted Average | Blends all inventory costs to determine a uniform average cost per unit. | Bulk goods, commodities, or businesses with mixed inventory batches. | Total cost of inventory divided by total units yields the average cost per unit. |

| Lower of Cost or Market (LCM) | Inventory reported at the lower of historical cost or current market value. | Businesses with rapidly changing market prices or risk of inventory obsolescence. | If cost is $15/unit but market value drops to $12/unit, inventory is valued at $12. |

The choice of valuation technique can significantly affect gross profit, income taxes, and inventory turnover ratios—making it a strategic decision for every business.

Periodic vs. Perpetual Inventory Systems

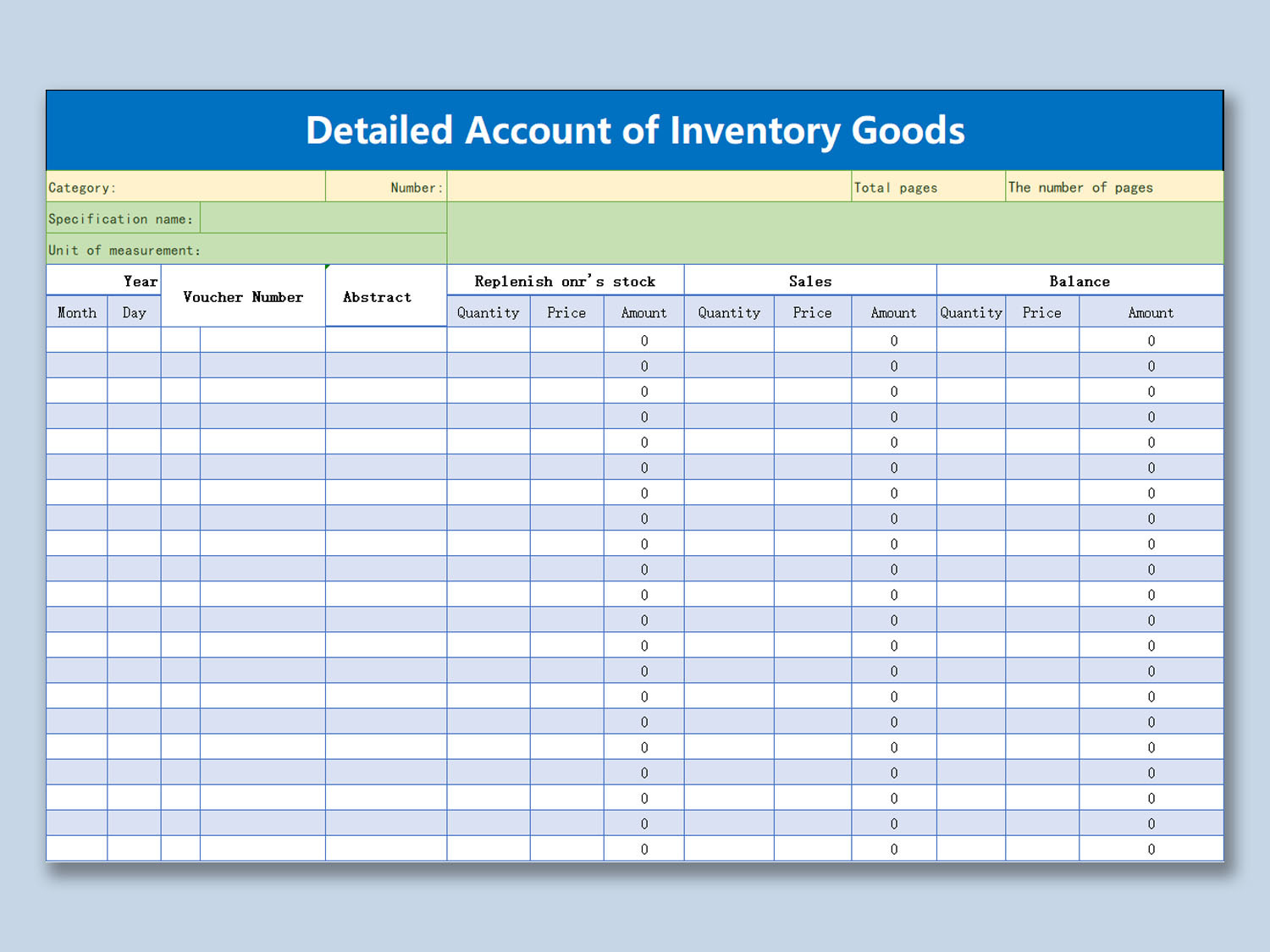

Businesses use either periodic or perpetual inventory systems to manage stock levels and record transactions. The choice between these systems shapes the frequency of updates, the detail of available information, and the resources required for inventory management. Understanding the core differences is crucial for selecting the most effective approach for a given business model.

Periodic inventory systems record inventory transactions at set intervals (usually monthly, quarterly, or annually) by physically counting stock, while perpetual systems update inventory records in real-time with each transaction. Periodic systems require less technology but may provide outdated information, whereas perpetual systems offer instant accuracy but demand more robust software and controls. The choice impacts decision-making, theft detection, and the ability to respond quickly to market changes.

Inventory Account Reconciliation and Auditing

Maintaining the integrity of inventory records requires regular reconciliation and periodic auditing. Reconciliation involves comparing recorded inventory balances with actual physical counts to identify discrepancies, while audits help ensure compliance, detect fraud, and validate internal controls. Both processes are cornerstones of financial accuracy and operational transparency.

- Physically count inventory at scheduled intervals.

- Compare physical counts with recorded balances in the inventory account.

- Investigate and resolve any differences found.

- Update records to reflect resolved discrepancies.

- Document findings and corrective actions for future reference and audit trails.

Common discrepancies and solutions include:

- Unrecorded inventory losses (theft, spoilage): Address by improving security and storage practices.

- Error in data entry or transaction recording: Implement double-check procedures and staff training.

- Misplaced or miscounted items: Use barcode scanning and regular spot checks.

- Obsolete or unsellable inventory: Write down or write off assets as needed and review procurement policies.

Role of Inventory Accounts in Financial Reporting

Inventory accounts play a crucial role in shaping a company’s financial statements. The inventory balance directly affects the balance sheet as a current asset and is a key component in calculating the cost of goods sold (COGS) on the income statement. Accurate inventory figures ensure reliable profit reporting and inform investor and management decisions.

| Statement | Entry Name | Impact | Description |

|---|---|---|---|

| Balance Sheet | Inventory (Current Asset) | Increases asset value and working capital | Reflects the cost of unsold goods owned by the business at period end. |

| Income Statement | Cost of Goods Sold (COGS) | Decreases gross profit | Represents the direct costs attributable to inventory sold during the period. |

| Balance Sheet | Inventory Write-down/Obsolescence | Reduces asset value, impacts net income | Adjusts inventory to reflect lower market value or lost items. |

| Income Statement | Inventory Loss/Gain | Impacts net income | Results from theft, shrinkage, or recovery of previously written-off stock. |

Consistent and accurate inventory reporting underpins the credibility of all financial statements, directly affecting ratios, borrowing capacity, and investor confidence.

Best Practices for Managing Business Inventory Accounts

Properly managing inventory accounts requires a combination of robust processes, technology adoption, and vigilant control mechanisms. Implementing best practices not only ensures data accuracy but also drives operational efficiency, reduces costs, and mitigates risks associated with shrinkage and obsolescence.

- Conduct regular and surprise inventory counts to verify accuracy.

- Segregate duties among staff handling inventory recording, approving transactions, and performing physical counts.

- Utilize inventory management software for real-time tracking and automated reporting.

- Establish clear documentation procedures for each inventory transaction.

- Set reorder points and monitor stock levels to avoid overstocking or stockouts.

- Review aging inventory reports to identify slow-moving or obsolete items promptly.

- Train employees on inventory handling and fraud prevention protocols.

Implementing inventory management software can streamline processes by:

- Providing instant access to current inventory levels and transaction history.

- Integrating with accounting systems for seamless updates to financial records.

- Supporting barcode/RFID tracking for more accurate physical counts.

- Automating alerts for low stock, expirations, or unusual activity.

To minimize shrinkage and obsolescence:

- Enforce secure storage and surveillance in warehouses and retail locations.

- Regularly review and update inventory policies and controls.

- Develop strategies for timely disposal, discounting, or donation of unsellable inventory.

Illustrative Example: Inventory Account Workflow

The following workflow Artikels the end-to-end process a typical business follows to manage its inventory account, from purchase to sales. This detailed table can be used as a reference for designing internal controls and staff training, as each step highlights key checkpoints and responsible parties.

| Step Number | Description | Responsible Party | Key Document |

|---|---|---|---|

| 1 | Place order with supplier based on demand forecast and reorder levels. | Purchasing Department | Purchase Order |

| 2 | Receive goods and inspect for quality and quantity accuracy upon arrival. | Receiving/Quality Control | Receiving Report |

| 3 | Update inventory records to reflect newly acquired items. | Inventory Clerk | Inventory Log/System Entry |

| 4 | Store goods securely and appropriately label for tracking. | Warehouse Staff | Stock Location Sheet |

| 5 | Process customer orders and pick items from inventory for delivery. | Sales/Logistics | Sales Order, Pick List |

| 6 | Ship goods to customers and record inventory outflow in system. | Shipping Department | Shipping Document, Invoice |

| 7 | Conduct periodic physical counts and reconcile records as needed. | Inventory Auditor | Physical Count Sheet, Reconciliation Report |

| 8 | Review reports for discrepancies or aging inventory, then take corrective actions. | Inventory Manager | Inventory Aging Report, Adjustment Memo |

This workflow ensures every movement of inventory is tracked, documented, and reviewed, supporting both operational control and financial accuracy. Each step incorporates both prevention and detection controls to safeguard against errors and fraud.

Last Recap

Understanding business inventory account is key for building a strong foundation in any company’s financial practices. With the right knowledge and tools, you can streamline your inventory processes, minimize errors, and set your business up for long-term success. Mastering inventory accounts doesn’t just keep your records tidy—it powers better decision-making across your entire operation.

Commonly Asked Questions

What is a business inventory account used for?

A business inventory account is used to record, track, and monitor all inventory movements, helping businesses keep accurate records of the goods they own and their value.

How often should inventory accounts be updated?

Inventory accounts should be updated regularly—ideally in real time with a perpetual system or at least at each reporting period with a periodic system—to ensure accuracy in financial statements.

Can inventory accounts affect a company’s profits?

Yes, the way inventory is accounted for can impact reported profits since inventory valuation methods influence the cost of goods sold and taxable income.

What are some common mistakes in managing inventory accounts?

Common mistakes include not recording transactions promptly, overlooking shrinkage or obsolescence, using inconsistent valuation methods, and failing to reconcile regularly.

Do small businesses need a separate inventory account?

Even small businesses benefit from having a dedicated inventory account, as it provides clarity on stock levels, cost control, and accurate financial reporting.