business inventories report 2 14 18 brings to light a comprehensive overview of inventory levels across major American industries as of February 14, 2018, capturing the attention of businesses, analysts, and market watchers. This report not only charts the course of supply, demand, and production but also paints a vivid picture of the economic landscape at the start of 2018, inviting readers to explore the forces shaping the market at that crucial moment.

The report covers a variety of sectors including manufacturing, wholesale, and retail, breaking down their inventory levels and detailing the month-over-month and year-over-year changes. With its timely release in the economic calendar, it provides valuable insights into the pace of economic growth, signals from supply chains, and the underlying health of different industries. The report’s methodology ensures that the collected data is both reliable and actionable for stakeholders across the board.

Overview of the Business Inventories Report (February 14, 2018)

The Business Inventories Report released on February 14, 2018, offered a comprehensive snapshot of inventory levels across the U.S. economy at the start of the year. This report, published by the U.S. Census Bureau, provides timely insight into business activity, helping analysts, investors, and policymakers gauge the pace of economic growth and anticipate potential shifts in production or demand.

The report covered major categories of the business sector, including manufacturing, retail, and wholesale trade. Each month, these sectors report the value of goods held in inventory, which acts as a barometer of supply chain health and future output. The main economic indicators measured include total inventory values, monthly and yearly changes, and the ratio of inventories to sales.

Within the broader economic context of early 2018, the February report arrived at a time when the U.S. economy was experiencing steady growth and low unemployment. As part of a regular release schedule, this data was closely watched to detect early signs of economic acceleration or slowdown, making it an essential reference for both Wall Street professionals and Main Street businesses.

Businesses Included and Economic Indicators Measured

The Business Inventories Report incorporates data from three core sectors:

- Manufacturing: Tracks goods produced but not yet sold, including raw materials, work-in-progress, and finished products.

- Retail: Measures the value of goods held by retailers, from small shops to large chains, ready for consumer purchase.

- Wholesale: Covers inventories of goods held by wholesalers, acting as intermediaries between manufacturers and retailers.

These figures collectively offer an up-to-date perspective on the movement of goods throughout the economy, acting as a leading indicator for shifts in demand or production planning.

Economic Calendar Placement

In the timeline of major U.S. economic reports, the business inventories data for February 2018 complemented other key releases such as retail sales and industrial production. The report provided valuable context, helping market participants interpret whether rising inventories signaled confidence in future sales or a potential slowdown in demand.

Components and Data Breakdown

The February 2018 Business Inventories Report segmented its data into several main categories, reflecting the diverse sectors included. Understanding these divisions helps clarify how inventory levels vary according to industry-specific dynamics and broader economic trends.

Main Data Categories Covered

Each sector in the report is measured with precision to reflect current asset holdings:

- Manufacturing Inventories: Values for raw materials, work-in-progress, and finished goods.

- Retail Inventories: Goods held at all points of retail, from stores to warehouses.

- Wholesale Inventories: Goods stored by wholesalers awaiting distribution to retailers or other buyers.

Inventory Levels by Sector

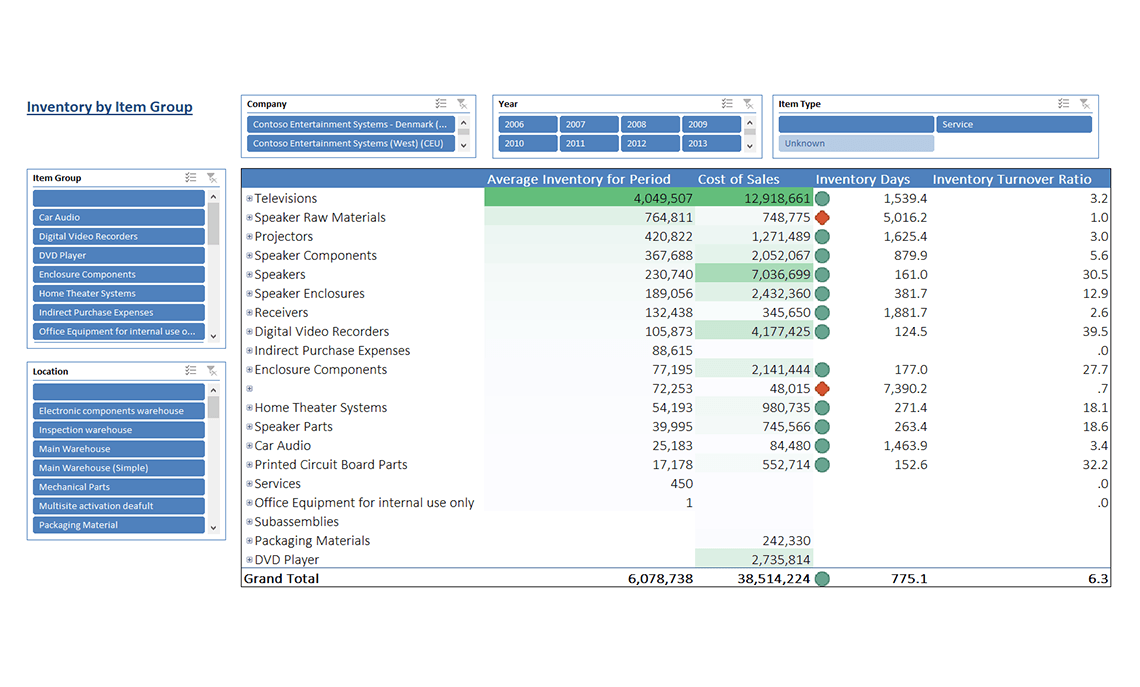

The following table illustrates example inventory levels and their changes for February 2018. These figures are representative and provide a clear view of sector-specific dynamics.

| Sector | Inventory Level (in $ billions) | Month-over-Month Change (%) | Year-over-Year Change (%) |

|---|---|---|---|

| Manufacturing | 660.3 | +0.6 | +3.2 |

| Retail | 620.9 | +0.7 | +2.5 |

| Wholesale | 610.1 | +0.8 | +4.9 |

Data Collection and Compilation Methodology

The report’s accuracy depends on rigorous data collection. Businesses in each sector regularly submit inventory figures to the Census Bureau, either monthly or quarterly, using standardized reporting forms. The agency then verifies, aggregates, and seasonally adjusts the data to remove recurring fluctuations that might distort month-to-month comparisons. This approach ensures that the final numbers reflect underlying economic realities rather than short-term market noise.

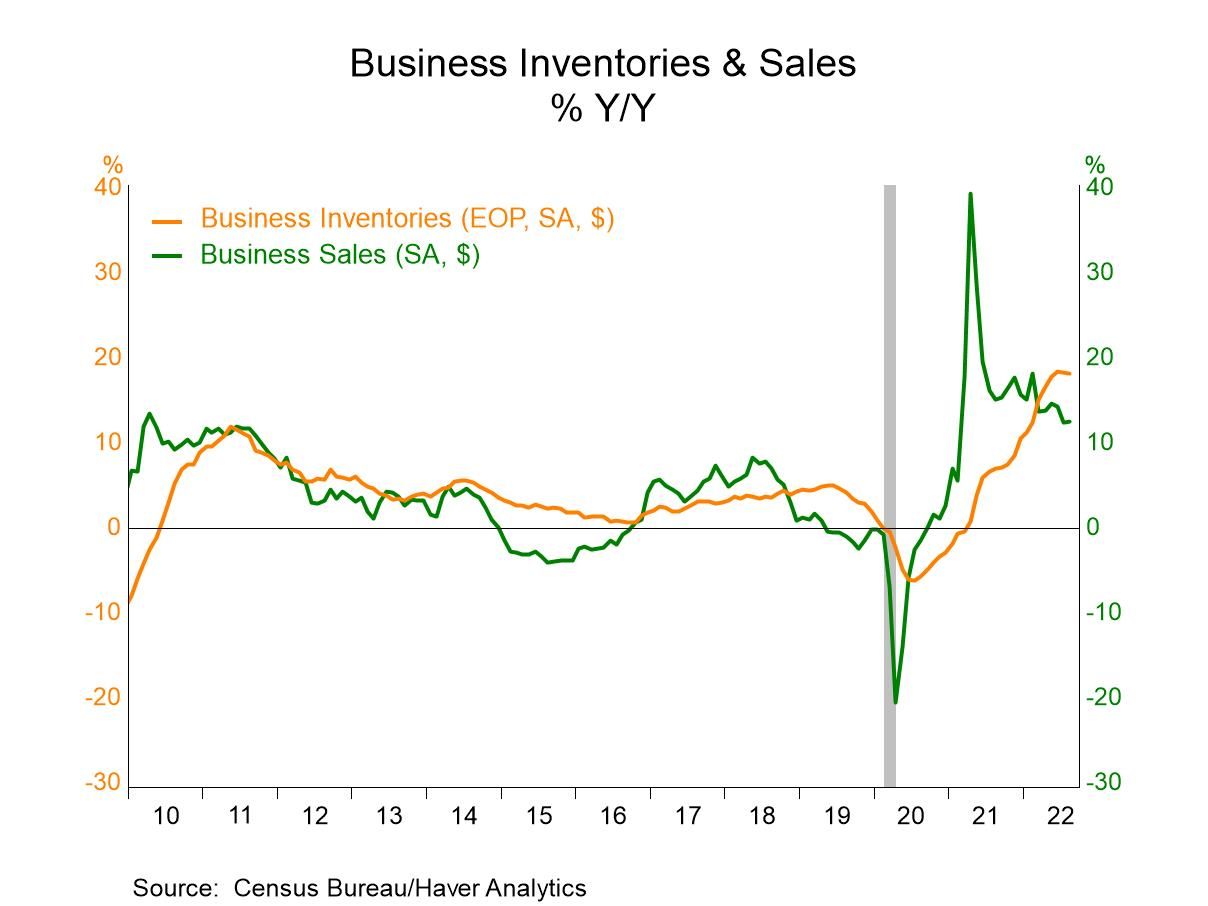

Economic Implications of Inventory Changes

Inventory levels are a critical gauge of economic health, influencing everything from GDP growth to supply chain management and corporate strategy. Fluctuations in inventories can either drive or dampen production, affecting employment, investment, and overall business confidence.

Impact of Inventory Fluctuations on Growth and Business Planning

Understanding how inventory changes ripple through the economy is essential for business leaders and policymakers. When inventories rise, it can indicate either strong expectations for future sales or, conversely, unsold goods piling up due to weaker demand. Declining inventories may signal robust sales or cautious production planning.

- Rising inventories may prompt businesses to scale back production, affecting factory output and employment.

- Falling inventories can lead to increased orders and higher output if businesses expect continued demand.

- High inventory-to-sales ratios may point to oversupply, causing downward pressure on prices.

- Sudden shifts in inventory levels often precede broader economic turning points, making this data valuable for forecasting.

Inventory Accumulation and Gross Domestic Product (GDP)

The relationship between business inventories and GDP is nuanced but significant. Inventory investment is a component of GDP calculation, and its changes directly influence reported economic growth. For instance, a sharp buildup of unsold goods adds to GDP in the short term but may foreshadow a slowdown if sales don’t materialize.

“Inventory changes are embedded in the calculation of GDP, with increases adding to growth and reductions subtracting from it. Persistent inventory accumulation can signal overproduction, while drawdowns often indicate robust final demand.”

Comparison with Previous and Subsequent Reports: Business Inventories Report 2 14 18

Examining trends across consecutive business inventories reports reveals valuable context for interpreting the February 2018 data. Comparing with prior months and the previous year’s figures highlights the direction and momentum of inventory changes.

Key Differences and Similarities in Inventory Data

The table below organizes essential figures from three reporting periods, illustrating how inventory levels evolved over time.

| Report Date | Total Inventory (in $ billions) | Monthly Change (%) | Yearly Change (%) |

|---|---|---|---|

| January 2018 | 1,870.2 | +0.4 | +3.0 |

| February 2018 | 1,891.3 | +0.7 | +3.5 |

| February 2017 | 1,827.6 | +0.3 | — |

Trends and Anomalies around February 2018, Business inventories report 2 14 18

During early 2018, inventory growth accelerated modestly compared to the end of 2017. This uptick reflected a mix of optimistic business sentiment and ongoing restocking after a strong holiday season. Notably, the year-over-year increase in inventories was more pronounced in wholesale and manufacturing than in retail, suggesting divergent patterns among sectors as consumer demand and industrial output evolved.

Industry-Specific Inventory Patterns

Inventory patterns can vary significantly by industry, influenced by sector-specific factors such as seasonality, consumer trends, and supply chain dynamics. The February 2018 report offered insights into how different industries adjusted their stock levels in response to market conditions.

Sectoral Inventory Trends in February 2018

Distinct inventory movements across sectors highlighted varying business strategies and challenges at that time. Below, key trends are summarized to underscore these differences.

- Retailers increased inventories moderately, preparing for spring sales and responding to steady consumer spending.

- Manufacturers saw a slight rise in finished goods, reflecting efforts to keep pace with anticipated orders from domestic and global customers.

- Wholesalers reported the largest inventory gains, particularly in durable goods categories like machinery and equipment, positioning themselves for potential demand surges.

Factors Influencing Inventory Changes by Sector

Multiple factors shaped inventory behavior within each industry:

- Retail: Stock levels were guided by seasonal merchandise shifts and the need to quickly replenish bestsellers after the holiday period. Retailers also faced pressure to optimize inventory turnover in an increasingly competitive environment.

- Manufacturing: Increased inventories often stemmed from both higher output and ongoing supply chain investments, as firms sought to avoid potential production delays by maintaining adequate raw material stocks.

- Wholesale: Wholesalers expanded inventories in response to strong business investment and expectations of rising sales, particularly for products tied to construction and capital goods markets.

Influence on Financial Markets and Policy Decisions

The release of business inventory data can sway financial markets and influence economic policymaking. Investors, economists, and central bankers all monitor inventory reports for clues about the health of the economy and future trends.

Market Effects and Investor Reactions

Inventory data affects market sentiment in several ways. A larger-than-expected increase may cause concern about unsold goods, while a decline can signal strong demand.

- Stock indices may fluctuate if the data hints at changing business conditions or shifts in consumer demand.

- Commodity prices can react as supply expectations change, particularly for raw materials tied closely to manufacturing output.

- Investor confidence may rise or fall based on whether inventory trends suggest economic expansion or contraction.

Policy Implications for Central Banks

Central banks and policymakers analyze inventory trends to fine-tune interest rate decisions and gauge the need for economic stimulus. Sustained inventory buildups may prompt caution, while shrinking inventories can support a more aggressive policy stance.

“When inventories rise rapidly, policymakers may interpret the trend as a signal of weakening demand, potentially delaying interest rate hikes. In contrast, shrinking inventories can justify tightening monetary policy if demand is deemed strong and inflationary pressures rise.”

Illustrative Market Scenarios

To better understand typical reactions to major inventory changes, consider the following real-world scenario:

“Following a surprise jump in inventories, equity markets may dip as investors worry about excess supply and softening sales. Conversely, a sharp inventory drawdown can boost both equity prices and commodity markets, reflecting optimism about future production and consumer demand.”

Visualizing Business Inventories Data

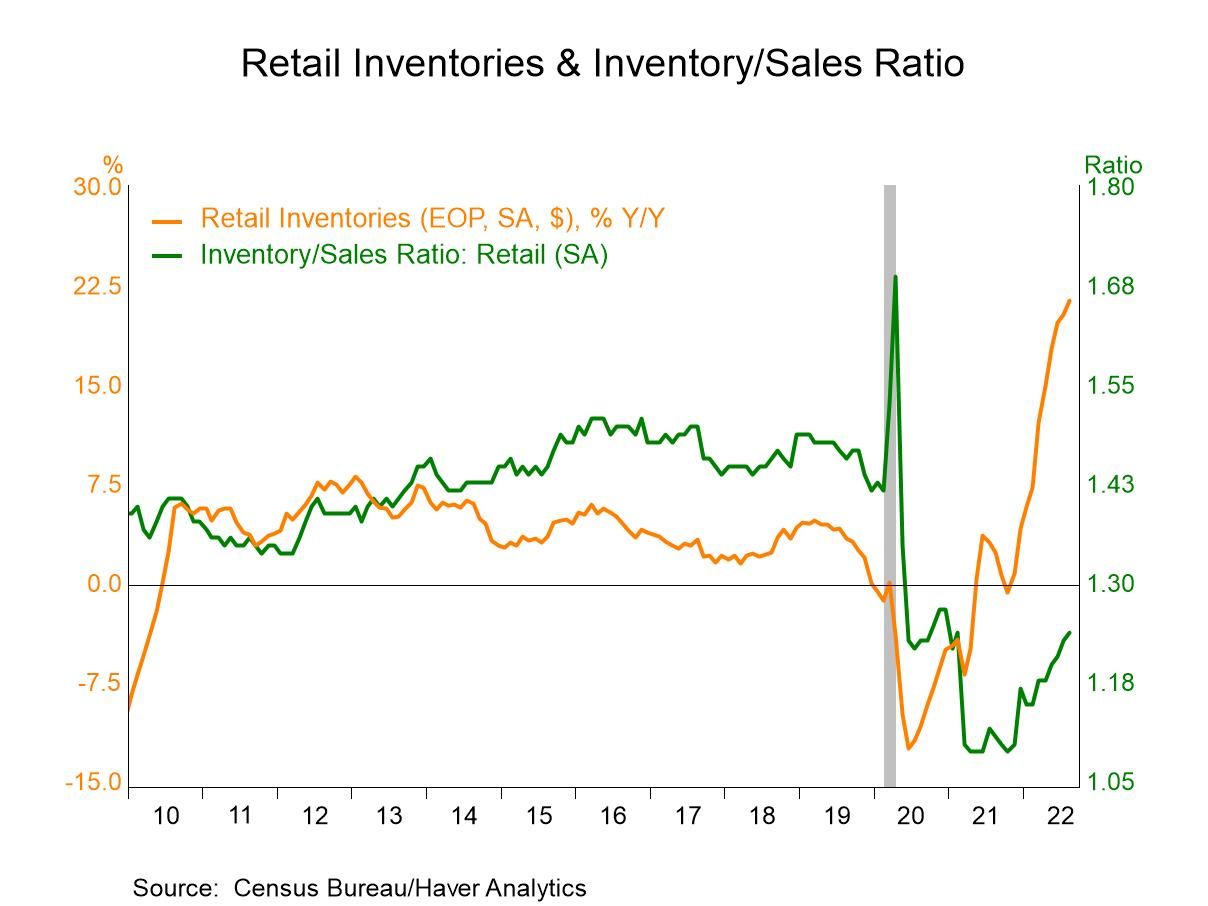

Effective data visualization brings the story of business inventories to life, making complex trends accessible and actionable. Charts and graphs can reveal patterns that are difficult to spot in raw data tables, aiding decision-makers and analysts alike.

Best Practices for Data Visualization

Creating clear and informative visuals requires thoughtful design. The following formats are commonly used to illustrate inventory levels and trends:

- Line Charts: Plotting inventory levels over time highlights cyclical patterns, turning points, and long-term growth or decline.

- Bar Graphs: Comparing inventory changes by sector or product type provides immediate visual context for which industries are driving overall trends.

- Stacked Area Charts: Displaying cumulative inventories across sectors shows their relative contributions to the total and uncovers shifting industry dynamics.

- Inventory-to-Sales Ratio Graphs: Visualizing this key metric can indicate when inventories are outpacing or lagging behind sales, a critical signal for business health.

Insights from Inventory Visualizations

Well-constructed visuals enable rapid assessment of economic conditions. For example, a sudden spike in a line chart of wholesale inventories might prompt deeper analysis of supply chain resilience or upcoming pricing pressures. Alternatively, a declining inventory-to-sales ratio could indicate mounting demand and the need for businesses to ramp up production.

Sample Layouts for Inventory Data Visualization

Designing an insightful dashboard or report page typically involves:

- A time-series line chart at the top, offering a high-level view of total inventory changes across several years.

- A grouped bar chart below, breaking down month-over-month or year-over-year changes by sector.

- A heatmap to the side, illustrating inventory-to-sales ratios by industry, helping to spot which sectors are under or overstocked.

- Annotations or callouts marking significant events, such as sharp inventory changes linked to policy shifts or major market movements.

These elements, when combined, foster intuitive analysis and support informed decision-making for a wide range of stakeholders.

Final Review

In summary, business inventories report 2 14 18 offers a detailed window into February 2018’s inventory dynamics, revealing how various industries managed their stock levels and adapted to economic shifts. By examining trends, comparing historical data, and analyzing the broader impact on markets and policies, this report remains an essential resource for anyone seeking to understand the complex interplay between inventories and the larger economy.

Clarifying Questions

What is the purpose of the business inventories report 2 14 18?

The report aims to track inventory levels across major industries, providing insight into economic trends and helping businesses and policymakers make informed decisions.

Which industries are included in the report?

The report includes data from manufacturing, retail, and wholesale sectors, covering a large portion of the business landscape.

How does inventory data affect financial markets?

Significant changes in inventory levels can impact investor confidence, influence stock prices, and affect policy decisions related to interest rates and economic stimulus.

Why is the report’s February 14, 2018 date significant?

This date places the report early in the year, providing a benchmark for understanding how economic trends and industry responses unfold throughout 2018.

How can businesses use insights from this report?

Companies can use the findings to adjust their inventory strategies, anticipate market shifts, and benchmark their performance against industry trends.