business inventories economic indicator sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. In the world of economics, understanding how inventories fluctuate across businesses can unlock powerful insights about the broader economy’s health and momentum.

Business inventories economic indicator refers to the total amount of goods that companies have on hand, including raw materials, goods in process, and finished products ready to sell. These inventory levels are tracked by both government agencies and private organizations, offering a snapshot of supply chains, demand trends, and potential shifts in the market. When analyzed in context, inventory data can signal whether businesses are preparing for growth, bracing for slowdown, or adjusting to changing consumer behaviors, making it a valuable tool for investors, policymakers, and managers alike.

Introduction to Business Inventories as an Economic Indicator

Business inventories represent the total stock of goods that companies hold at any given time, playing a significant role in the broader macroeconomic landscape. These inventories encompass everything from raw materials and components to work-in-progress and finished products ready for sale. Understanding business inventories is vital for analysts, policymakers, and investors because inventory fluctuations provide early signals about the state of the economy.

In macroeconomic analysis, the level and movement of business inventories are tracked to assess economic momentum, supply chain conditions, and the efficiency of production and distribution systems. A sharp increase or decrease in inventories can reflect shifts in consumer demand, disruptions in supply chains, or strategic changes in corporate operations. As an indicator, business inventories offer a snapshot of how well supply is aligning with demand across the economy.

National statistical agencies and industry groups measure business inventories at both broad and granular levels. At the national level, figures are aggregated from surveys and reports across manufacturing, wholesale, and retail sectors, while sectoral data allows for more detailed analysis within particular industries.

Components and Classifications of Business Inventories

Types of Inventories in Business Operations

Business inventories are not homogeneous; they are generally classified into several categories based on their stage within the production and distribution process. This classification helps businesses manage stock efficiently, optimize cash flow, and maintain responsiveness to market needs. The main types of inventories include:

- Raw Materials – basic inputs used in the manufacturing process

- Work-in-Progress (WIP) – items that are in the process of being transformed into finished products

- Finished Goods – completed products ready for sale to end consumers or other businesses

Inventory Examples Across Major Industries

Inventory needs vary dramatically between industries. For better understanding, here is a comparative table outlining inventory types across different sectors:

| Sector | Raw Materials | Work-in-Progress | Finished Goods |

|---|---|---|---|

| Automotive Manufacturing | Steel, Plastics | Body Assembly, Engine Assembly | Completed Vehicles |

| Retail | Textiles, Packaging | N/A (minimal WIP) | Clothing, Electronics |

| Pharmaceuticals | Chemical Compounds | Formulation, Testing | Packaged Medicines |

| Food Processing | Grains, Meats | Milling, Cooking | Packed Food Products |

Sectoral Differences in Inventory Management

While inventory categories are broadly similar, the emphasis and management of each type can differ significantly between the manufacturing, wholesale, and retail sectors. Manufacturers typically carry more raw materials and WIP, focusing on production planning and minimizing production bottlenecks. Wholesalers maintain stocks of finished goods to supply retailers efficiently, while retailers primarily manage finished goods, aiming to match shelf stock with consumer demand and minimize excess.

Methods for Collecting and Reporting Business Inventory Data

Organizations Responsible for Inventory Data Collection

Accurate inventory data is essential for economic analysis, and several government agencies and private organizations are tasked with collecting and publishing this information. These entities use standardized surveys and administrative records to ensure data consistency and reliability.

The U.S. Census Bureau, for example, conducts monthly and quarterly surveys of manufacturers, wholesalers, and retailers to gather comprehensive inventory statistics. Industry associations and market research firms may supplement official figures with more granular or real-time data, especially in fast-moving sectors.

Data Collection Processes and Sources

The collection of inventory data generally involves direct surveys, sampling, and the aggregation of administrative records. Companies report their inventory levels either monthly or quarterly as part of standardized reporting requirements. Data is then validated, adjusted for seasonality, and published in official economic reports.

| Report Name | Sector Covered | Frequency | Publishing Organization |

|---|---|---|---|

| Manufacturing and Trade Inventories and Sales | Manufacturing, Wholesale, Retail | Monthly | U.S. Census Bureau |

| Quarterly Financial Report | Manufacturing, Retail | Quarterly | U.S. Census Bureau |

| Industry-Specific Inventory Surveys | Selected Industries | Varies | Private Research Firms |

| Wholesale Inventories Survey | Wholesale | Monthly | U.S. Census Bureau |

Relationship Between Business Inventories and Other Economic Indicators

Interaction Between Inventories and Broader Economic Signals

The movement of business inventories is closely linked with a range of other economic indicators. Changes in inventory levels can influence Gross Domestic Product (GDP) calculations, signal shifts in the pace of sales, and reflect underlying trends in industrial production. When inventories rise faster than sales, it may suggest weakening demand, while rapid inventory drawdowns often indicate robust consumption or supply constraints.

Inventory levels also play a pivotal role in supply chain management, affecting production scheduling, procurement, and logistics across industries.

- Gross Domestic Product (GDP)

- Industrial Production

- Retail and Wholesale Trade Sales

- Purchasing Managers’ Index (PMI)

- Producer Price Index (PPI)

- Consumer Price Index (CPI) via potential supply impacts

Supply Chain Dynamics Reflected in Inventory Data

Inventory data provides deep insight into the state of supply chains. High inventory accumulation can point to overproduction or weakened sales, while low inventories may suggest strong demand or bottlenecks in procurement and logistics. These dynamics are critical for identifying turning points in the business cycle and anticipating policy or operational adjustments.

Interpreting Fluctuations in Business Inventories

Implications of Rising and Falling Inventory Levels

Fluctuations in business inventories have important implications for economic growth and the stages of the business cycle. Rising inventories can either indicate optimism about future sales or signal unsold stock as demand weakens. Conversely, declining inventories may result from robust sales or intentional stock reductions in anticipation of market downturns.

Analysts look for context—such as whether inventory changes are matched by shifts in sales or production—to interpret these movements accurately.

Examples of Inventory Trends During Economic Cycles

Real-world data helps illustrate how inventory trends can serve as leading or lagging indicators during recessions and recoveries. The table below highlights historical scenarios:

| Period | Inventory Trend | Economic Context | Outcome |

|---|---|---|---|

| 2008-2009 Global Financial Crisis | Sharp Inventory Buildup | Sudden drop in consumer demand | Production cuts, widespread layoffs |

| 2010-2012 Recovery | Rapid Inventory Drawdown | Rebound in consumption | Increased production, GDP growth |

| 2020 COVID-19 Pandemic | Volatile Inventory Fluctuations | Supply chain disruptions, unpredictable demand | Sporadic shortages, restocking surges |

| 2023-2024 Supply Chain Normalization | Stabilizing Inventory Levels | Gradual return of steady demand and supply | Normalization in production and trade |

Impact of Inventory Management on Business Performance

Inventory Optimization Strategies in Practice

Businesses continually work to balance sufficient stock with cost efficiency. They use a variety of inventory management strategies, including just-in-time (JIT) practices that minimize storage, and safety stock approaches that protect against disruptions.

Effective inventory management enhances operational flexibility, reduces carrying costs, and improves the ability to respond quickly to market changes.

- Just-in-Time (JIT): Reduces storage costs but increases risk if supply chains are disrupted.

- Safety Stock: Provides a buffer against fluctuations but ties up capital in inventory.

- Demand Forecasting: Aligns inventory with expected sales, reducing both shortages and overstock.

- Automated Inventory Tracking: Increases accuracy and supports faster decision-making.

Procedures for Cost Minimization and Responsiveness

Companies frequently review purchasing schedules, collaborate closely with suppliers, and employ advanced analytics to optimize reorder points. Inventory turnover ratios are monitored to ensure that products move efficiently from warehouse to customer, minimizing the likelihood of obsolescence and markdowns.

Visualizing Business Inventory Data for Economic Insights

Illustrations and Conceptual Diagrams of Inventory Movements

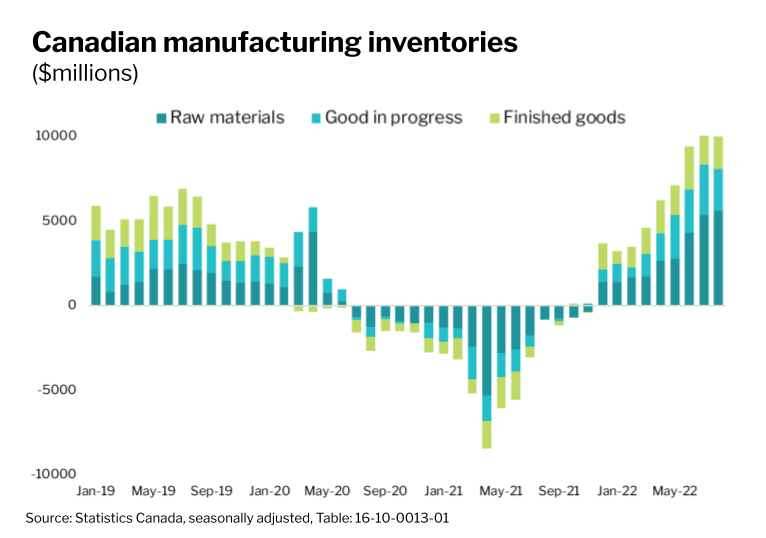

Data visualization is essential for extracting actionable insights from inventory statistics. Well-designed charts, graphs, and diagrams can uncover seasonality, highlight turning points, and reveal trends that are otherwise hidden in raw data.

A typical inventory movement chart will plot inventory levels on the y-axis against time on the x-axis, allowing observers to identify cycles, peaks, and troughs. Layering this with sales or production lines provides a multidimensional view, making it easier to spot divergences and anticipate economic inflection points.

Creating Effective Visual Representations of Inventory Data, Business inventories economic indicator

The clarity and impact of inventory data visualization depend on the choice of chart type, color scheme, and annotation. Line charts are useful for tracking trends over time, while bar charts can compare inventories across sectors or time periods. Heatmaps can highlight regions or products with unusually high or low inventory turnover.

To maximize interpretability, visualizations should include clear labels, time markers for significant events (like economic shocks), and notes that guide users through key patterns. Integrating inventory data with sales, production, or macroeconomic indicators in a single visual can offer comprehensive perspectives for strategic decision-making.

Final Conclusion

In summary, keeping a close watch on the business inventories economic indicator gives us a front-row seat to the ongoing drama of market cycles and economic performance. As inventory data moves and trends unfold, readers and decision-makers alike gain the ability to anticipate shifts, make smarter choices, and stay ahead in an ever-changing economic landscape.

FAQ Insights: Business Inventories Economic Indicator

Why do economists track business inventories economic indicator?

Economists monitor business inventories because changes in inventory levels can signal shifts in production, demand, and overall economic health. Rising inventories may suggest slowing sales, while falling inventories could point to increased demand or effective supply chain management.

How frequently are business inventory reports released?

Most countries release business inventory data monthly, although some organizations may provide quarterly updates. The frequency helps ensure timely analysis of economic trends.

Can business inventories economic indicator predict recessions?

While no single indicator predicts recessions perfectly, sharp changes in business inventories often coincide with economic turning points, making this indicator a useful tool for forecasting.

Do all industries experience inventory changes in the same way?

No, inventory levels and changes can vary widely between industries such as manufacturing, wholesale, and retail, based on production cycles and consumer demand patterns.

How can businesses use inventory data to improve performance?

By regularly analyzing inventory data, businesses can optimize stock levels, reduce carrying costs, and respond more quickly to market changes, enhancing both efficiency and profitability.