Best insurance rates in nc are more accessible than you might think, and finding the right policy can be a real game-changer for your wallet and peace of mind. Whether you’re a new resident or a long-time North Carolinian, understanding how to navigate the local insurance landscape is crucial for getting the most value out of your coverage.

North Carolina offers a variety of insurance options—ranging from auto, home, and renters to health insurance—each with its own set of benefits and considerations. By learning about the different types of insurance, what affects their rates, and the many ways to save, you’ll be far better equipped to make smart choices that protect what matters most to you.

Best Insurance Rates in NC

Finding the best insurance rates in North Carolina requires an understanding of the many products available, the factors that influence pricing, and how to navigate the competitive local market. North Carolina residents benefit from a robust range of insurance offerings, with state-specific nuances that impact both coverage and costs. This guide will break down the essential insurance types, key factors affecting premiums, top providers, and proven strategies for securing the most favorable rates in the Tar Heel State.

Overview of Insurance Types Available in NC

North Carolina offers a wide array of insurance options for residents, addressing protection needs for vehicles, homes, health, and personal possessions. Understanding the main insurance categories and what they typically cover is the first step toward making informed, cost-effective coverage decisions.

| Type | Typical Coverage | Average Cost (Annual) | Key Providers |

|---|---|---|---|

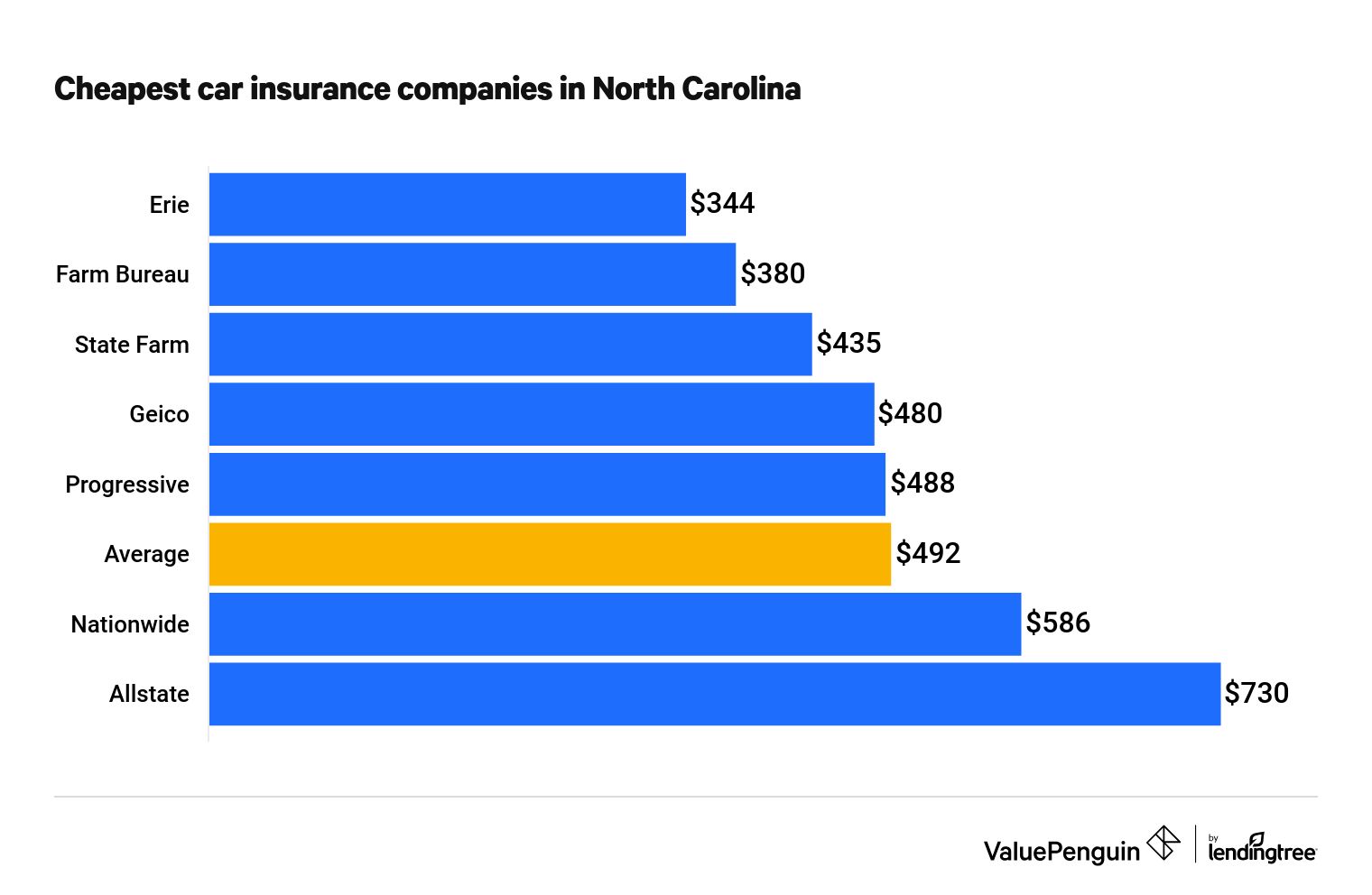

| Auto Insurance | Liability, collision, comprehensive, uninsured/underinsured motorist | $1,325 | GEICO, State Farm, Nationwide, Progressive |

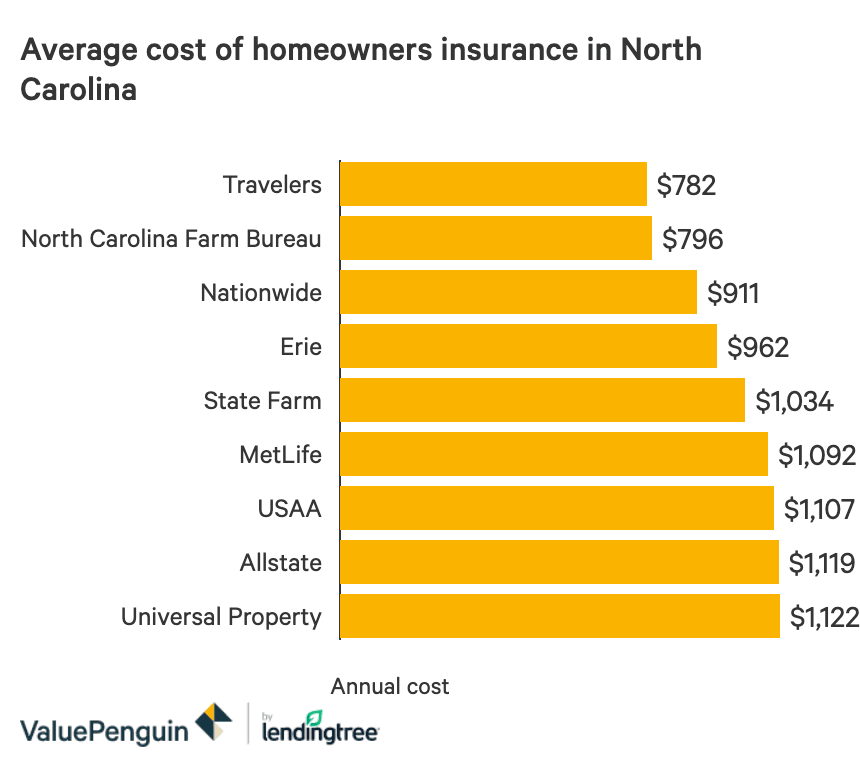

| Home Insurance | Dwelling, personal property, liability, disaster coverage | $1,095 | Allstate, State Farm, USAA, Erie Insurance |

| Health Insurance | Medical, hospitalization, prescriptions, preventive care | $6,200 (individual marketplace) | Blue Cross NC, Cigna, UnitedHealthcare |

| Renters Insurance | Personal property, liability, loss of use | $140 | Lemonade, State Farm, Nationwide |

Factors Affecting Insurance Rates in NC

Insurance premiums in North Carolina are determined by a combination of personal, geographic, and regulatory factors. Understanding these influences can help individuals anticipate changes in rates and take steps to optimize their insurance costs.

- Location: Urban areas or regions with higher crime rates and accident frequencies typically see higher premiums.

- Age: Younger drivers or new homeowners often face higher rates due to perceived risk.

- Driving History: Clean driving records are rewarded with lower auto insurance premiums, while violations increase costs.

- Claims History: Multiple past insurance claims can signal higher risk, raising premiums across most insurance types.

- Regional Weather Risks: Coastal and tornado-prone areas in NC may experience elevated home and auto premiums.

- State and Local Laws: Insurance requirements and consumer protection laws directly influence base rate calculations and available discounts.

Leading Insurance Providers in NC

The North Carolina insurance market features both national brands and regional specialists. Comparing the strengths, customer satisfaction, and discount offerings of these providers can help residents select companies that align with their priorities.

| Provider Name | Coverage Options | Customer Rating (out of 5) | Notable Discounts |

|---|---|---|---|

| State Farm | Auto, home, renters, life | 4.3 | Multiple policy, safe driver, accident-free |

| Blue Cross NC | Health, dental, vision | 4.1 | Wellness, family plan, autopay |

| Nationwide | Auto, home, renters, pet | 4.0 | Bundle, safe home, loyalty |

| Lemonade | Renters, homeowners | 4.4 | Bundling, claims-free, pay-in-full |

Methods for Finding the Lowest Insurance Rates

To secure the most competitive insurance rates in North Carolina, residents must use a combination of research, comparison, and negotiation. Leveraging both online and offline resources enhances the chances of finding the best deal for any coverage need.

- Request quotes from at least three different insurers to compare pricing and coverage details.

- Utilize online comparison platforms to quickly evaluate multiple options and discounts.

- Consult local insurance agents who understand regional risks and can recommend tailored policies.

- Review policy details annually to ensure rates remain competitive and coverage aligns with life changes.

- Ask about available discounts and eligibility during the quote process.

Discounts and Savings Opportunities in NC Insurance

North Carolina insurance companies offer a range of discounts designed to reward safe behavior, loyalty, and bundled policies. Knowing which discounts you qualify for can significantly reduce your premiums while maintaining essential coverage levels.

| Discount Type | Eligibility Criteria | Average Savings (%) | Applicable Insurance Types |

|---|---|---|---|

| Bundle Discount | Purchase multiple policies (auto + home/renters) | 10-25% | Auto, Home, Renters |

| Safe Driver | No recent accidents or violations | 15-30% | Auto |

| Loyalty Discount | Continuous coverage with same insurer | 5-10% | All types |

| Claims-Free | No claims in past 3-5 years | 10-20% | Home, Renters |

State Regulations and Consumer Protections

North Carolina enforces specific regulations to ensure fair insurance practices and protect consumers. The North Carolina Department of Insurance (NCDOI) oversees licensing, investigates complaints, and provides educational resources for policyholders throughout the state.

In North Carolina, insurance companies must receive approval from the NCDOI before implementing rate increases, giving consumers a safeguard against sudden or excessive premium hikes.

Step-by-Step Procedure for Applying for Insurance in NC

Applying for insurance in North Carolina is a systematic process designed to ensure transparency and informed decision-making. By following these practical steps, you can secure coverage that fits your needs and budget.

- Assess your insurance needs based on your assets, lifestyle, and potential risks.

- Research providers and gather multiple quotes to compare policies and pricing.

- Review coverage options, exclusions, and any special endorsements offered.

- Provide personal and relevant information for underwriting, such as driving record or property details.

- Select your preferred policy and review the final terms and premium amounts.

- Submit your application along with any required documentation or payments.

- Receive confirmation of coverage and policy documentation from the insurer.

Tips for Reducing Insurance Premiums in North Carolina, Best insurance rates in nc

Proactive steps can lead to notable reductions in insurance costs for North Carolina residents. Implementing these strategies not only saves money but also helps maintain appropriate coverage regardless of market shifts.

- Increase your deductible to lower monthly or annual premiums while maintaining adequate coverage.

- Maintain a strong credit score, as many insurers consider credit when setting rates.

- Bundle multiple policies (such as auto and home) with the same provider for a discount.

- Invest in safety features for your home or vehicle, such as alarms or anti-theft devices.

- Consistently review and update your policy to eliminate unnecessary coverage or adjust to life changes.

- Participate in safe-driving programs or defensive driving courses to qualify for discounts.

Common Mistakes to Avoid When Choosing Insurance in NC

Avoiding frequent missteps can help North Carolina policy seekers secure optimal protection without unnecessary expense or exposure. Awareness of these pitfalls is key to making informed, confident insurance decisions.

- Underinsuring property or assets, resulting in insufficient coverage during a claim.

- Overlooking policy exclusions or limitations that may leave gaps in coverage.

- Focusing solely on price without comparing policy features or service reputation.

- Failing to disclose accurate personal or risk information, which could lead to denied claims.

- Neglecting to reevaluate insurance needs after major life or property changes.

Descriptive Illustration: Navigating Insurance Policies in NC

Imagine a detailed flowchart that guides a North Carolina resident through the insurance selection process. The illustration starts with identifying coverage needs (auto, home, health, or renters) and branches into researching trusted providers. Each branch details comparing quotes, assessing coverage features (such as deductibles, liability limits, and exclusions), and noting available discounts based on personal circumstances.

Decision points are clearly marked, such as choosing between higher deductibles for lower premiums or selecting additional riders for specialized protection. The path also highlights checking regulatory safeguards, reading consumer reviews, and consulting local agents for personalized advice. The final steps in the guide show submitting an application, reviewing policy documents, and setting reminders for annual reviews, emphasizing how a well-informed approach leads to securing the best insurance rates and coverage in North Carolina.

Last Recap

In summary, getting the best insurance rates in NC is all about knowing your options, understanding the factors that drive costs, and taking advantage of discounts and local resources. With the right approach, you can secure the coverage you need at a price that fits your budget, ensuring peace of mind as you go about your daily life in North Carolina.

FAQ Explained

What types of insurance are most popular in North Carolina?

The most common insurance types in NC include auto, home, health, and renters insurance, with auto and homeowners insurance being nearly essential for most residents.

How often should I compare insurance quotes in NC?

It’s a good idea to compare insurance quotes at least once a year or whenever you experience a major life change like moving, buying a home, or getting a new car.

Do insurance rates in NC vary by city or region?

Yes, insurance rates can differ significantly based on your location within North Carolina due to factors like crime rates, weather risks, and local regulations.

Can I bundle different types of insurance for better rates?

Absolutely. Many providers offer discounts if you bundle auto, home, or renters insurance policies together with the same company.

Are there any state-specific discounts for NC residents?

Some insurers offer unique discounts in North Carolina for things like hurricane-proofing your home, being a good student, or maintaining a clean driving record.