business inventory accounting program sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset. Managing inventory and financial records efficiently is at the heart of successful business operations, and these programs have become essential tools for organizations looking to streamline workflows and boost accuracy.

By automating inventory tracking, integrating with other business systems, and supporting a range of valuation methods, the business inventory accounting program empowers companies from retail to manufacturing to take control of stock, compliance, and reporting. The evolution of these programs reflects broader technological shifts, providing scalable, customizable solutions that fit businesses of all sizes while keeping data secure and actionable.

Introduction to Business Inventory Accounting Programs

Business inventory accounting programs are specialized software solutions designed to manage, track, and report on inventory levels, costs, and valuation in a systematic and efficient manner. These programs are central to modern business operations, enabling organizations to maintain optimal stock levels, prevent shortages or overstocking, and support accurate financial reporting. Their primary objectives include streamlining inventory control, improving financial transparency, and automating processes that would otherwise be prone to human error.

Main Functions and Objectives of Inventory Accounting Programs

The fundamental functions of inventory accounting software are tailored to help businesses maintain real-time visibility over their inventory assets. These core objectives typically include:

- Automating inventory tracking and reconciliation processes

- Integrating with procurement, sales, and accounting systems

- Supporting various inventory valuation methods for compliance and reporting

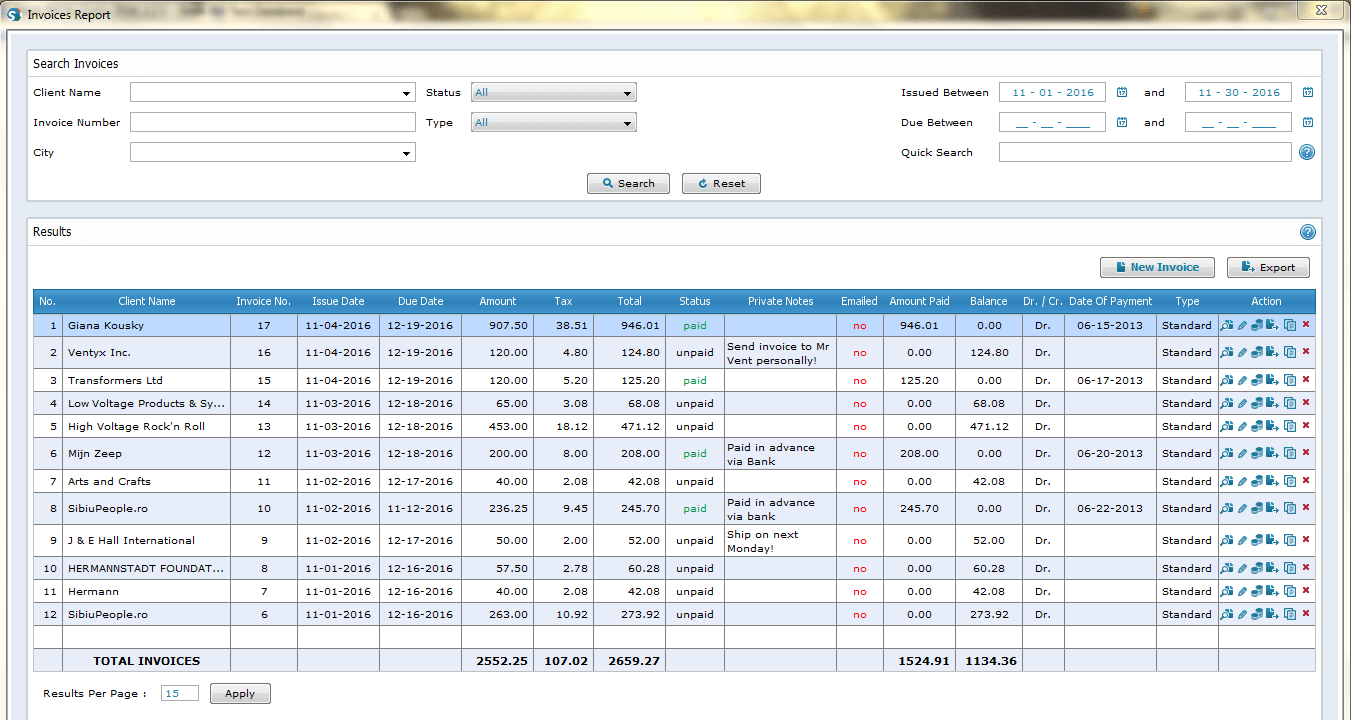

- Generating detailed reports for analysis and decision-making

This ensures businesses can make data-driven decisions, optimize working capital, and comply with financial regulations.

Typical Users and Industries Benefiting from Inventory Accounting Programs

A wide range of users leverage inventory accounting software, but certain sectors gain particular value from its implementation. Industries such as retail, wholesale, manufacturing, distribution, and e-commerce rely heavily on these programs. Typical users include:

- Inventory managers seeking to control stock levels and minimize losses

- Accountants responsible for accurate financial records

- Operations managers coordinating purchasing and logistics

- Business owners and executives requiring real-time business insights

These roles benefit from increased visibility, faster reconciliation, and improved decision-making capabilities.

Evolution of Inventory Accounting Software Over the Past Decade

Over the last ten years, inventory accounting solutions have evolved from basic spreadsheet-based tools into sophisticated, cloud-powered platforms. The shift has been marked by advancements in automation, mobile accessibility, and AI-driven analytics. Modern solutions now offer:

- Real-time, multi-location stock management

- Automated data capture through barcode/RFID technology

- Seamless integrations with e-commerce and enterprise systems

- Intelligent forecasting and analytics modules

This evolution has enabled businesses of all sizes to adopt scalable, adaptable, and more secure inventory accounting systems.

Essential Features of Inventory Accounting Programs

Modern inventory accounting programs are packed with features that streamline operational efficiency and support business growth. These features are designed to handle the complexities of inventory management while ensuring accuracy in financial reporting.

Core Components in Modern Inventory Accounting Programs

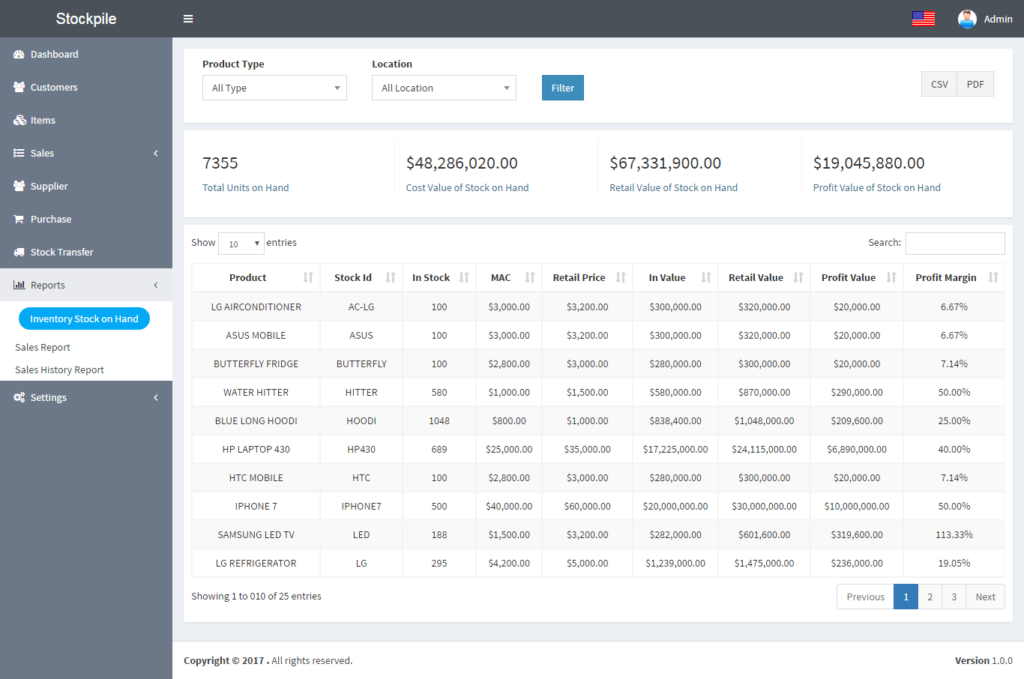

The following table summarizes the most essential components found in leading inventory accounting solutions, highlighting their benefits and typical use cases.

| Feature | Description | Benefit | Typical Use Case |

|---|---|---|---|

| Automated Stock Tracking | Real-time monitoring of inventory movement and balances | Reduces manual errors and saves time | Retailers monitoring daily sales and restocks |

| Integrated Order Management | Synchronizes sales, purchasing, and inventory records | Ensures accurate inventory counts and order fulfillment | Wholesale distributors managing multiple suppliers |

| Inventory Valuation | Supports multiple valuation methods (FIFO, LIFO, Weighted Average) | Enables compliance with accounting standards | Manufacturers needing regulatory compliance |

| Reporting and Analytics | Generates actionable reports, dashboards, and insights | Informs strategic decisions for inventory optimization | E-commerce businesses analyzing sales trends |

Automation in Stock Level, Sales, and Reorder Tracking

Automation capabilities are a defining feature of modern inventory accounting programs. By leveraging automated alerts for low stock, real-time updates from point-of-sale (POS) terminals, and predictive analytics for reorder points, businesses can substantially reduce the risk of stockouts or overstocking. Automation minimizes manual workload, increases accuracy, and accelerates response times across all inventory-related processes.

Integration with Other Business Software

Seamless integration with other business management systems amplifies the value of inventory accounting programs. Common integrations include:

- POS systems, enabling instant update of stock levels upon sale

- Enterprise Resource Planning (ERP) software for unified financial and operational data

- E-commerce platforms, ensuring consistent product availability information across online channels

These integrations eliminate data silos, enhance information flow, and drive operational efficiency throughout the organization.

Inventory Valuation Methods Supported

Inventory valuation is a critical aspect of inventory accounting, impacting not only the financial statements but also compliance with local and international accounting standards. Most inventory accounting programs offer multiple valuation methods to accommodate diverse business requirements.

Comparison of Inventory Valuation Methods, Business inventory accounting program

The following table provides an overview of the most common inventory valuation methods, their definitions, advantages, and typical application scenarios.

| Method | Definition | Advantages | Common Use |

|---|---|---|---|

| FIFO (First-In, First-Out) | Assumes oldest inventory items are sold first | Reflects current market costs in inventory; reduces risk of obsolete stock | Retail and perishable goods |

| LIFO (Last-In, First-Out) | Assumes newest inventory items are sold first | Potential tax benefits in periods of rising prices | Industries with stable or rising input costs (e.g., raw materials) |

| Weighted Average Cost | Calculates average cost of items available for sale during period | Smooths out price fluctuations; simplifies bookkeeping | Manufacturing and bulk inventory environments |

Impact on Financial Statements

The choice of inventory valuation method has direct implications for key financial metrics. For example, using FIFO in an inflationary environment typically results in lower cost of goods sold (COGS) and higher reported profits, as older, cheaper stock is accounted for first. In contrast, LIFO can lead to higher COGS and lower taxable income. Weighted Average Cost offers stability, making it easier to compare performance over time.

Compliance Requirements Across Regions

Compliance with inventory valuation methods varies by jurisdiction. For instance, International Financial Reporting Standards (IFRS) do not permit LIFO, while United States Generally Accepted Accounting Principles (US GAAP) allow it. Businesses operating globally must ensure their inventory accounting software supports compliant methods per each region’s regulatory framework, reducing the risk of audit issues and penalties.

Final Conclusion

In summary, business inventory accounting programs are game-changers for businesses navigating the complexities of modern operations. They deliver clarity, efficiency, and strategic insight, all while adapting to ever-changing technological and industry trends. With robust features, security, and scalability, these programs set businesses up for lasting success and growth.

Quick FAQs

What types of businesses benefit most from a business inventory accounting program?

Retailers, manufacturers, wholesalers, and e-commerce companies of all sizes benefit from these programs by improving inventory accuracy, financial reporting, and operational efficiency.

Can a business inventory accounting program work with my existing POS or ERP system?

Yes, most modern programs offer integration capabilities with popular POS and ERP platforms, allowing for seamless data sharing and process automation.

Is it difficult to migrate from manual inventory tracking to an automated program?

The migration process is straightforward with proper planning, data preparation, and support from the software provider, though it’s important to avoid common pitfalls such as poor data mapping and lack of staff training.

How does a business inventory accounting program help with compliance?

These programs support various inventory valuation methods and generate reports that meet regulatory standards, helping businesses comply with tax and financial reporting requirements.

Are there options for businesses with a limited budget?

Many inventory accounting programs offer tiered pricing, including freemium and subscription models, so businesses can choose a plan that fits their needs and budget.