business inventoriesfred introduces a dynamic look at how businesses and policymakers monitor inventory levels to gauge the pulse of the economy. By exploring the data tracked and published by FRED, readers gain a front-row seat to understanding how inventory shifts reflect broader economic health.

From the origins of FRED’s data collection to the nuts and bolts of how inventories are measured across manufacturing, wholesale, and retail sectors, this guide unpacks the significance of inventory trends. You’ll discover how to interpret data changes, connect inventories to other economic indicators, and utilize reporting techniques that make inventory data accessible and actionable for strategy and policy.

Overview of Business InventoriesFRED

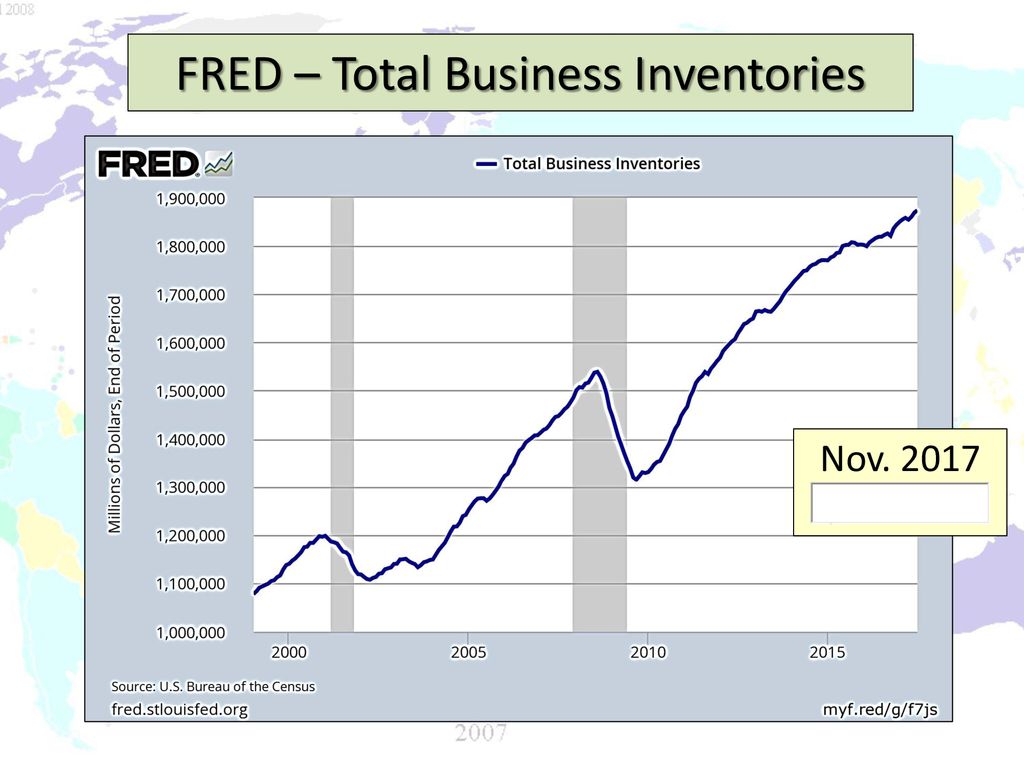

Business inventories tracked by FRED (Federal Reserve Economic Data) represent the value of goods that businesses in the United States hold in stock, awaiting sale or further processing. This data is a key gauge of supply chain health and economic momentum, providing a snapshot of how efficiently companies are matching their stock levels with ongoing demand.

Monitoring business inventories is crucial because it helps analysts, businesses, and policymakers understand the interplay between production, consumption, and economic growth. Excessive inventory may indicate slowing demand or overproduction, whereas low inventory can signal strong sales or supply constraints. Tracking these changes enables more informed strategic decisions and policy adjustments.

FRED began collecting and publishing business inventory data as part of its mission to provide accessible, reliable, and up-to-date economic statistics. Since its inception in 1991, FRED has aggregated data from various government sources, making it a go-to platform for anyone analyzing U.S. macroeconomic trends, including the critical area of business inventories.

Significance of Tracking Business Inventories

Understanding inventory levels is essential for assessing economic stability and predicting business cycles. Shifts in inventories can signal potential changes in production rates, employment, and even monetary policy responses. Businesses rely on this data to optimize operations, and economists use it to refine forecasts of economic growth or contraction.

“Business inventories data offer a real-time pulse on the flow of goods through the economy, highlighting imbalances that may affect everything from retail pricing to monetary policy.”

Data Sources and Collection Methods

FRED compiles its business inventories data from several reliable sources, with standardized methodologies to ensure accuracy and comparability. Primary sources include government agencies such as the U.S. Census Bureau and the Bureau of Economic Analysis, both of which have established reputations for comprehensive data collection.

Data is gathered through regular business surveys and administrative records, often monthly, to capture the latest inventory movements. These collections measure inventory levels across manufacturing, wholesale, and retail channels, providing a holistic view of supply chains. The frequency and granularity of the data make it especially valuable for trend analysis and short-term forecasting.

Features of FRED’s Data Collection, Business inventoriesfred

The following table provides a concise overview of the major sources, collection frequencies, data types, and coverage that define FRED’s business inventories dataset:

| Source | Frequency | Data Type | Coverage |

|---|---|---|---|

| U.S. Census Bureau | Monthly | Manufacturing, Wholesale, Retail Inventories | National |

| Bureau of Economic Analysis (BEA) | Quarterly | Aggregated Inventory Data | National |

| Industry Surveys | Varies (Monthly/Quarterly) | Sector-Specific | Selected Sectors |

Components of Business Inventories: Business Inventoriesfred

Business inventories are typically divided into three primary components: manufacturing, wholesale, and retail. Each plays a different role in the economic landscape and has distinct data characteristics. Together, they offer a comprehensive picture of how goods flow from production to the final point of sale.

Manufacturing inventories consist of raw materials, work-in-process, and finished goods held by producers. Wholesale inventories include goods purchased for resale to retailers or other businesses, often representing bulk quantities. Retail inventories cover items stocked by stores for direct sale to consumers. Understanding the makeup and dynamics of each component helps decode the broader inventory figures reported by FRED.

Major Inventory Categories and Examples

The table below clarifies the definitions of each component, along with practical examples:

| Component | Definition | Example |

|---|---|---|

| Manufacturing | Goods held by producers at various stages: raw materials, work-in-progress, and finished products. | Automobile parts, machinery, electronics components |

| Wholesale | Products purchased and stored by wholesalers for resale to retailers or businesses. | Bulk groceries, apparel stocks, building supplies |

| Retail | Goods held by retailers for final sale to consumers. | Clothing in stores, electronics on display, perishable foods |

Each component reflects a unique stage of the supply chain. Manufacturing inventories can signal shifts in production schedules, wholesale inventories highlight intermediate demand, and retail inventories reveal trends in consumer buying behavior. Balancing these inventories is critical for minimizing costs and avoiding supply disruptions.

Interpretation and Use of Business Inventories Data

Fluctuations in business inventories data require careful interpretation, as they can be driven by various factors including shifts in demand, changes in production rates, or supply chain disruptions. Rising inventories may result from slower sales or overproduction, often preceding a slowdown in manufacturing. Conversely, falling inventories could indicate robust sales or supply bottlenecks, which may push businesses to ramp up production.

The implications of these changes extend into broader economic outcomes. Rising inventory levels might signal caution for future growth, as businesses may reduce new orders until excess stock is cleared. On the other hand, rapidly decreasing inventories could drive price increases and spur additional investment in production.

Economic Scenarios Influenced by Inventory Changes

The following real-world situations highlight how inventory data can shape economic decisions and outcomes:

- A spike in retail inventories during the holiday season may suggest overestimated demand, prompting retailers to offer significant discounts post-holidays to clear excess stock.

- Manufacturers noticing rapid inventory drawdowns may expedite production schedules and increase hiring to meet stronger-than-expected demand.

- Policymakers monitoring rising wholesale inventories might interpret this as a slowdown in end-user demand, leading to cautious monetary policy adjustments.

- Investors may use inventory data to anticipate corporate earnings surprises, as higher inventories can undermine margins or foreshadow weaker sales.

Effective interpretation of business inventories data requires context, historical comparison, and an understanding of sector-specific dynamics.

Conclusive Thoughts

In summary, business inventoriesfred presents a comprehensive window into the ever-evolving world of business inventories, offering tools and insights that empower smarter decisions for businesses and policymakers alike. By understanding trends, overcoming challenges, and leveraging FRED’s data, anyone can stay ahead in a constantly shifting economic landscape.

FAQs

What is business inventoriesfred?

business inventoriesfred refers to the dataset and resources provided by the Federal Reserve Economic Data (FRED) platform, specifically tracking business inventory levels across various sectors of the economy.

How often are business inventories data updated on FRED?

Business inventories data are typically updated monthly, reflecting the latest available statistics from relevant sources.

Why do changes in business inventories matter for the economy?

Changes in business inventories can signal shifts in consumer demand, production adjustments, or economic slowdowns, offering early insights into broader economic trends.

Can small businesses benefit from monitoring business inventoriesfred?

Yes, small businesses can use FRED’s inventory data to benchmark industry trends, anticipate supply chain changes, and plan for shifts in demand.

Is business inventoriesfred data free to access?

Yes, all business inventories data on the FRED platform is freely accessible to the public.